Using Models to Estimate the Reasonable Ranges for Upswings and Downswings

This article is simultaneously published on Medium

The Chapter 1~4 section of this article is public content. Chapter 5~7 is the paid section will introduce how I strategically position myself in Bitcoin and my insights on its future development. It includes an in-depth analysis of Bitcoin's core characteristics, its evolution, data interpretation, mining cost calculations, estimated price fluctuation targets, and my personal Bitcoin strategy.

For more detailed content, feel free to purchase the full article.

How to purchase the article

1. VOCUS purchase link: Link

2. Google Drive online version(200U)

- USDT transfers only

- After transferring, email ch.knackofmatters@gmail.com with transfer details

- Upon confirmation, you'll receive access to the online PDF version

- No viewing expiration; the article will be updated in the PDF as new information is added

3. Bitcoin mining cost calculation Excel sheet(50U)

- USDT transfers only

- After transferring, email ch.knackofmatters@gmail.com with transfer details

- Upon confirmation, the Excel sheet will be sent to you

Pre-Summary

Bitcoin, much like gold, is a scarce asset. As fiat currencies lose their purchasing power, Bitcoin’s value will continue to rise. It's especially useful for hedging against inflation and as an appreciating asset. As a decentralized digital currency, Bitcoin is not only an emerging asset but also a part of the future of payments. As global consensus strengthens and more people recognize its potential, Bitcoin will play a bigger role in value storage and payment systems. For those who are still unsure, now is the perfect time to understand and embrace this asset. Don’t miss this opportunity that could reshape the future of your finances.

Contents

Chapter0 - Introduction

Chapter 1 - The Rise of Bitcoin: History Repeats Itself

Chapter 2 - Bitcoin's Nature: A Scarce, Anti-Inflation Asset

Chapter 2-1 - The Core Features of Bitcoin

Chapter 2-2 - The Blockchain Features of Bitcoin

Chapter 3 - The Accounting Principles of Bitcoin Mining

Chapter 3-1 - Bitcoin's Structure and Rules

Chapter 3-2 - The Evolution of Bitcoin Mining

Chapter 3-3 - Analyzing Global Mining Data Through Bitcoin Explorer

Chapter 4 - Comparative Analysis of Bitcoin and Various Assets

Chapter 4-1 - Bitcoin vs. Gold

Chapter 4-2 - Bitcoin Spot V.S. Bitcoin ETF

Chapter 4-3 - Institutional and Corporate Adoption of Bitcoin

Chapter 4-4 - My Views and Usage of Bitcoin Assets

(Paid)Chapter 5 - BTC Cycles and Price Range Estimations

(Paid)Chapter 6 - Thoughts on BTC’s Future Development

(Paid)Chapter 7 - Conclusion

Notes

References

Article Statement

Disclaimer

Chapter0 - Introduction

The 2008 financial crisis triggered massive global economic turmoil. In response to the crisis, many countries printed large amounts of money to stabilize their economies, which indirectly contributed to the birth of Bitcoin. Today, fiat currency credit systems are built on debt, but excessive borrowing has caused global economies to be heavily burdened by debt, heightening financial risks. Unrestrained money printing has led to asset price inflation, further widening the wealth gap. In some countries, economic fragility and excessive money printing have triggered hyperinflation, rapidly eroding people's wealth. Against this backdrop, I gradually became aware of the loss of purchasing power in fiat currencies, which is evident in rising prices and shrinking product sizes in daily life. Reflecting on the surge in asset prices since 2008, it's clear that failing to invest effectively early on only deepens the wealth gap.

In this context, Bitcoin has emerged as a new hedge asset and store of value due to its scarcity, global acceptance, and decentralized nature. I chose Bitcoin precisely because of its limited supply and halving mechanism, which ensures that its scarcity will continue to drive long-term value growth.

Although many countries have begun pushing for digital fiat currencies, ostensibly to enhance the convenience of electronic payments, in some authoritarian regimes, digital fiat currencies could become tools for governments to monitor and control their citizens. In contrast, Bitcoin's decentralization, immutability, and anonymity may offer the best solution for safeguarding individual financial freedom. Of course, Bitcoin's rise has not been without challenges—it has faced power struggles between traditional and new financial systems, along with numerous significant events that have shaped its journey. Bitcoin has gradually proven its value as a scarce asset, making it essential for long-term investors to understand its core characteristics and future development trends.

Next, I will comprehensively explore Bitcoin's development trajectory and future potential from various perspectives, including its historical background, intrinsic qualities, mining principles, asset attributes, and the comparison of price movement points during bull and bear cycles. Understanding these factors will help investors better grasp Bitcoin's long-term value and make more informed investment decisions in future markets.

Chapter 1 - The Rise of Bitcoin: History Repeats Itself

In 2008, the global financial system faced an unprecedented crisis, originating from the U.S. subprime mortgage market. Large numbers of people with unstable incomes could easily own multiple properties, leading to the collapse of the real estate market as subprime borrowers defaulted en masse. This caused a chain reaction in financial institutions. Two Wall Street giants—Bear Stearns and Lehman Brothers—faced severe liquidity crises. When Lehman Brothers declared bankruptcy, a domino effect ensued, throwing the entire financial market into panic. Interbank credit markets froze, stock markets plummeted, and the economy entered a recession. The crisis wiped out the wealth of countless American families, millions lost their jobs and homes, and economic uncertainty soared. The ripple effect spread across Europe, Canada, Asia, and other regions, leading to a global financial crisis.

As the 17th largest financial institution and the fifth-largest investment bank in the U.S., Bear Stearns was twice the size of the average U.S. financial company. Bear Stearns had approximately 5,000 trading partners, including banks, securities firms, hedge funds, pension funds, governments, and corporations, with 750,000 open derivative contracts. When the subprime crisis erupted, Bear Stearns’ balance sheet quickly deteriorated, causing a sharp decline in market confidence. Panic led to an unprecedented bank run. Within four days, reserves shrank from $18 billion to $2 billion, as investors and clients withdrew their funds. The liquidity crisis worsened, ultimately prompting the Federal Reserve to intervene and assist JPMorgan Chase in acquiring Bear Stearns at a symbolic price, preventing the bankruptcy from causing a larger market shock.

The panic triggered by Bear Stearns had not yet subsided when Lehman Brothers faced its own crisis on September 14, 2008. As the fourth-largest investment bank in the U.S., Lehman Brothers was similarly trapped in the subprime mire. By September 2008, Lehman Brothers ran out of cash and could not pay its debts, ultimately filing for bankruptcy protection. This reignited public panic, with concerns about further bank collapses. The U.S. government chose not to rescue Lehman Brothers, which escalated fears and led to more bank runs, deepening the financial crisis globally, as shown in Figure 1-1.

Figure 1-1, The Collapse of Lehman Brothers

After Lehman Brothers collapsed, American International Group (AIG) also faced financial difficulties on September 16, 2008. A downgrade in credit ratings and a bank run left AIG with severe liquidity issues. This prompted the Federal Reserve to announce an $85 billion emergency loan to prevent the company from going under due to a lack of liquidity, as shown in Figure 1-2.

Figure 1-2, AIG’s Liquidity Crisis (Source: Chart of the Decade: AIG and the Lesson of the Long View)

On September 19, 2008, the U.S. government implemented a series of emergency measures to stabilize financial markets. Key actions included large-scale fiscal stimulus, Fed interest rate cuts, and quantitative easing (QE) policies. These measures were essentially large-scale money printing to ensure ample liquidity in the markets. The U.S. government deemed certain large financial institutions "Too Big to Fail"—believing their collapse would wreak havoc on the entire economy. Thus, the government chose to bail out these institutions, injecting massive funds to keep them afloat. While these measures stabilized the markets, they also drastically increased the money supply, diluting the purchasing power of ordinary people, while financial institutions and Wall Street giants survived the crisis, as illustrated in Figure 1-3.

Figure 1-3, U.S. Money Supply: Currency Issued by Central Government

Amid global panic, despair, unemployment, and high pressure, on October 31, 2008, a mysterious figure under the pseudonym Satoshi Nakamoto published a white paper titled Bitcoin: A Peer-to-Peer Electronic Cash System, giving birth to the concept of Bitcoin (BTC). Bitcoin was seen as a revolution against the traditional financial system, proposing a peer-to-peer electronic cash system. Its core idea was to create a decentralized, transparent, immutable ledger without the need for trusted intermediaries, and with a fixed supply of Bitcoin, preventing the inflationary abuse of monetary power by central financial institutions. One of its most revolutionary aspects was transferring the power of money issuance from central governments to individuals; those who helped maintain the Bitcoin network could earn Bitcoin as a reward.

The Bitcoin Network was launched on January 3, 2009, when Satoshi Nakamoto mined the first Bitcoin block, known as the Genesis Block or Block 0. In this block, Satoshi left a note reading, "The Times 3 January 2009 Chancellor on brink of second bailout for banks," referencing the day’s Times headline, reflecting the severity of the financial crisis and the government’s intervention. This note is highly symbolic, often interpreted as expressing distrust in the traditional financial system and emphasizing the philosophy behind Bitcoin, as shown in Figure 1-4.

Figure 1-4, Bitcoin Genesis Block Information (Source: The New and Renewed Bitcoin Narrative)

In 2020, the global economy faced another significant challenge. The COVID-19 pandemic, which began in late 2019 in China, rapidly spread worldwide. Governments implemented travel restrictions, lockdowns, and other measures to curb the virus, as shown in Figure 1-5, leading to a sharp decline in global economic activity. Businesses ground to a halt, unemployment surged, and market confidence was shaken, creating an unprecedented economic shock.

In response to this crisis, the Federal Reserve launched a series of fiscal stimulus policies to stabilize financial markets, ensure liquidity for businesses, and provide emergency assistance to households to prevent a deeper economic crisis.

- On March 3, 2020, the Fed cut interest rates by 50 basis points, lowering the federal funds rate to 1.00%–1.25%.

- On March 15, 2020, the Fed cut interest rates again by 100 basis points to 0.0%–0.25%, while announcing a $700 billion quantitative easing plan.

- On March 17, 2020, the Fed established the Commercial Paper Funding Facility (CPFF) and Money Market Mutual Fund Liquidity Facility (MMLF) to support short-term financing markets.

- On March 23, 2020, the Fed announced unlimited quantitative easing, expanding the purchase of government bonds and mortgage-backed securities from $700 billion to an unlimited amount.

- On March 27, 2020, the U.S. government signed the CARES Act, approving $2.3 trillion in relief funds, including direct payments, unemployment relief, and small business loans.

- On April 9, 2020, the Fed announced a new $700 billion economic support plan, expanding corporate bond purchases to support credit markets.

- On April 24, 2020, the U.S. government signed the Paycheck Protection Program and Health Care Enhancement Act, providing an additional $484 billion for small business loans, medical support, and virus testing.

- On December 21, 2020, Congress passed a $900 billion economic stimulus package, which included $600 direct payments, additional unemployment relief, and small business assistance.

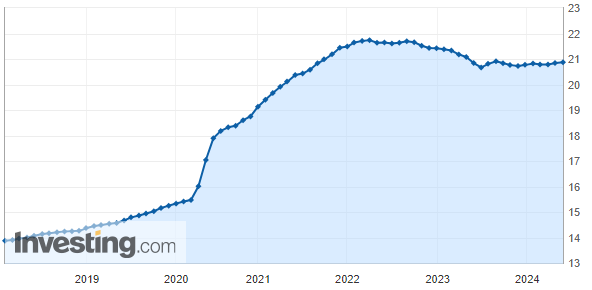

Given the painful lessons of the 2008 financial crisis, the U.S. government and the Federal Reserve acted swiftly with strong fiscal stimulus policies to stabilize the financial markets and maintain liquidity during the pandemic. However, this massive influx of aid further expanded the money supply (US$15.5Tn to US$19.1Tn), exacerbating concerns about inflation, as shown in Figure 1-6.

Figure 1-6, U.S. M2 Money Supply

During the pandemic in 2020, Bitcoin underwent its third halving event on May 11, reducing block rewards from 12.5 BTC to 6.25 BTC. The significance of this halving was heightened by the concurrent global economic downturn caused by COVID-19. That year, the U.S. government and the Federal Reserve injected approximately $3.7 trillion to stabilize the market. The intent was to keep the economy running, but the measures resembled those taken during the 2008 financial crisis. Ultimately, the global economy was rescued, but some bore the cost of these interventions. In the block mined during the May 11 halving, a note was inscribed: "With $2.3 Trillion Injection, Fed’s Plan Far Exceeds Its 2008 Rescue," referencing the New York Times headline from that day, as shown in Figure 1-7. This striking parallel to history underscores Bitcoin’s core value as an inflation-resistant, hedge asset and store of value.

Figure 1-7, Bitcoin’s Third Halving Block Information

Chapter 2 - Bitcoin's Nature: A Scarce, Anti-Inflation Asset

Chapter 2-1 - The Core Features of Bitcoin

This chapter introduces the intrinsic value and characteristics of Bitcoin (BTC), providing an understanding of its long-term value. The essence of Bitcoin lies in its role as a digital asset, with core features such as value preservation, anti-inflation, scarcity, necessity, autonomy, and hedging, as shown in Figure 2-1.

Figure 2-1, Key Features of Bitcoin

● Store of Value

Bitcoin's value preservation stems from its fixed supply of 21 million coins, which prevents arbitrary increases in supply like fiat currencies, protecting it from inflation. After each halving event, the supply decreases, and by 2032, the total supply will reach 99%. Over the next hundred years, the remaining 1% will be distributed. As of 2024, the released Bitcoin is mostly concentrated in the hands of large holders (whales) and rarely circulates in the market. When public demand for Bitcoin increases and the available supply from mining and circulation is insufficient, Bitcoin's value rises, creating an anti-inflationary store of value. This explains why Bitcoin is considered "digital gold," effectively preserving value as a hedge against currency devaluation and economic uncertainty, as shown in Figure 2-2.

Figure 2-2, Bitcoin Supply Curve

● Deflation

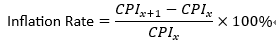

Fiat currencies (e.g., USD, EUR, TWD, etc.) experience inflation [Note. 1] driven by factors like demand-pull, cost-push, and increases in the money supply (built-in inflation). Demand-pull and cost-push inflation tend to be short-term and localized, but increases in the money supply create sustained, systemic effects, leading to widespread price increases for goods and services. Central banks' continuous expansion of the money supply exacerbates inflation, making it difficult to reverse. This long-term inflationary pressure affects economic growth, investment decisions, and consumer behavior. This was a key factor after the 2008 financial crisis when the U.S. introduced quantitative easing and low-interest-rate policies, leading to a flood of currency and driving up prices for goods (food, clothing, housing, transportation, education, entertainment) and assets (real estate, stocks, precious metals, luxury goods, Bitcoin). As shown in Figure 2-3, the purchasing power of $100 has been diluted by about 97.51% from 1913 to 2023, driven by a 702-fold increase in money supply from 1913 to 2013 (red dotted line). From 2013 to 2018, the supply increased by 29.2 times, and from 2013 to 2023, it increased by 42.3 times.

Bitcoin's fixed supply of 21 million coins and its halving mechanism reduce the issuance of new Bitcoin every four years, making the circulating supply increasingly scarce. This results in a declining inflation rate and enhances Bitcoin's anti-inflationary properties. Meanwhile, the over-issuance of fiat currencies highlights Bitcoin’s anti-inflation nature even more. As shown in Figure 2-4, the purchasing power of $1 in fiat currency continues to decrease, while the purchasing power of 1 BTC increases over time. This trend is particularly evident when comparing the cost of buying an iPhone with Bitcoin, as shown in Figure 2-5.

Figure 2-3, U.S. Dollar Purchasing Power Trend

Figure 2-4, Inflation of Fiat Currency vs. Anti-Inflation of Bitcoin

Figure 2-5, Purchasing Power of Bitcoin Compared to iPhone Prices

● Scarcity

The old saying, "Scarcity creates value," explains why rare items—whether due to limited supply, age, craftsmanship, or fame—are highly valued. This holds true for luxury cars, watches, brand-name products, precious metals, antiques, and limited-edition items. Like gold, Bitcoin’s limited supply drives up its value, especially in times of explosive demand growth. Bitcoin is mined through block rewards, and with every four-year halving, its supply tightens. By 2020, 90% of Bitcoin had already been mined, with much of it being hoarded and not circulating in the market. As Bitcoin’s production and circulation diminish, its scarcity pushes up the price, which in turn increases its value, creating a virtuous cycle. This scarcity is one of the main reasons why Bitcoin attracts long-term investors.

● Rigid Demand

A commodity must fulfill a rigid demand to drive its use as a medium of exchange. For example, real estate fulfills the rigid demand for "housing and security," prompting people to buy or rent properties. The same concept applies to Bitcoin. Initially, Bitcoin fulfilled four rigid demands: smuggling, money laundering, drug trafficking, and collecting. Bitcoin's decentralized and anonymous nature created strong demand for anonymous transactions. Nowadays, Bitcoin’s usage has evolved, and future rigid demands may include payments, legal tender, foreign exchange reserves, value preservation, asset proof, and hedging.

The rigid demand for Bitcoin continues to drive its value. With the application of blockchain technology and the expansion of the cryptocurrency market, Bitcoin’s use cases are becoming more diverse. Whether for international remittances, cross-border payments, or as an investment tool for digital assets, Bitcoin shows strong demand. This sustained market demand further solidifies its value.

● Autonomy

Bitcoin's autonomy is a key feature that sets it apart from traditional fiat currencies. Fiat currencies derive their value from the credit of the issuing nation and are geographically restricted—for example, the euro can only be used in Europe, and the Australian dollar only in Australia. The value of these currencies relies on the economic and political stability of the respective countries. When political turmoil or economic crises occur, these currencies can quickly devalue or even become worthless. Some nations have abandoned large amounts of bad debt and replaced old currencies with new ones, as seen in Figure 2-6 during the hyperinflation in Germany in 1923, Figure 2-7 with Taiwan's 1949 currency reform (where 40,000 old Taiwan dollars were exchanged for 1 new Taiwan dollar), and the Gold Yuan Crisis in Shanghai in 1948, as well as the hyperinflation in Shanghai during the same period (video link). Numerous countries have experienced hyperinflation, as shown in Figure 2-8. These monetary issues usually stem from political instability, economic collapse, policy failures, or war.

When a country faces political instability, an economic crisis, or a banking collapse, the banking system is often the first to feel the pressure of mass withdrawals, creating a domino effect across financial institutions. Banks often respond by imposing withdrawal limits or declaring debts unrecoverable, leading to people's wealth being restricted or even lost, as shown in Figure 2-9.

The emergence of Bitcoin marks the first time in human history that individuals have the opportunity to fully control the power of "minting Bitcoin." People now have full control over their private wealth without interference from any government or institution, and Bitcoin's value is based on global consensus. Anyone, anywhere in the world, can use Bitcoin to purchase goods or services. This decentralized nature makes Bitcoin a global currency that surpasses the limitations of traditional fiat currencies. Bitcoin's autonomy is also evident in its censorship resistance. Since Bitcoin transactions occur peer-to-peer without intermediaries, no government or institution can easily block or control them. This is particularly important for people living in economically unstable regions or those affected by financial sanctions, as Bitcoin allows them to bypass traditional financial systems and independently manage and use their wealth.

Following Bitcoin’s introduction of “monetary sovereignty,” various blockchain projects began to emerge across different sectors. These projects issued their own cryptocurrencies (Coins) or digital tokens (Tokens) to support their ecosystems. Some of these projects aim to address current industry pain points, others engage in disruptive innovation, create new applications, or are simply focused on profiting from the market. The development in this space is incredibly diverse.

![Figure 2-6, 1923 German Hyperinflation (Source:[歷史照片]1923 年德國超級通脹︰2000 億馬克買一個麵包的時代)](https://resize-image.vocus.cc/resize?norotation=true&quality=80&url=https%3A%2F%2Fimages.vocus.cc%2F51d7069f-a7d7-49f6-bab4-69f12f4ac45e.jpg&width=479&sign=FozF3sFuYhodtRj75SdxoyRreqoz2JyITLpr8bs_XNs)

Figure 2-6, 1923 German Hyperinflation (Source:[歷史照片]1923 年德國超級通脹︰2000 億馬克買一個麵包的時代)

Figure 2-7, Taiwan’s 1949 Currency Reform

Figure 2-8, Countries Where Fiat Currency Systems Have Collapsed (1900-Present)

Figure 2-9, Global News on Bank Runs

● Hedge

Bitcoin’s hedging nature can be divided into two key aspects: protecting against asset devaluation and serving as a recognized medium of exchange during times of turmoil.

When economic problems arise, countries often respond with quantitative easing, which increases the money supply and dilutes the purchasing power of fiat currency. As an anti-inflation asset, Bitcoin preserves value. By including Bitcoin in a diversified investment portfolio, investors can hedge against the devaluation of fiat currencies and increase the stability of their asset allocation.

Another hedging feature is Bitcoin’s role as a “recognized medium of exchange in times of turmoil,” although we hope the world never sees the day when this is necessary. Imagine a situation where global political or economic instability occurs, or worse, war breaks out. In such cases, the only widely accepted forms of payment may be the U.S. dollar, gold, and Bitcoin. If one must flee, standing in line at a bank or ATM to withdraw cash would be too late—banks may even limit withdrawals. Carrying gold would also be problematic, as you would need to exchange it for currency, and traveling with heavy gold would be impractical. On the other hand, carrying Bitcoin requires only a cold wallet stored on any device, allowing for rapid mobility. As long as the recipient accepts Bitcoin, essential goods or services can be purchased quickly.

Another hedging feature is Bitcoin’s role as a “recognized medium of exchange in times of turmoil,” although we hope the world never sees the day when this is necessary. Imagine a situation where global political or economic instability occurs, or worse, war breaks out. In such cases, the only widely accepted forms of payment may be the U.S. dollar, gold, and Bitcoin. If one must flee, standing in line at a bank or ATM to withdraw cash would be too late—banks may even limit withdrawals. Carrying gold would also be problematic, as you would need to exchange it for currency, and traveling with heavy gold would be impractical. On the other hand, carrying Bitcoin requires only a cold wallet stored on any device, allowing for rapid mobility. As long as the recipient accepts Bitcoin, essential goods or services can be purchased quickly.

This scenario has already occurred. In 2022, a Ukrainian refugee named Fadey converted his savings into Bitcoin and exchanged $600 worth of Bitcoin for Polish currency to pay for bus tickets, accommodation, and food as he fled to Poland. The rest of his savings were stored in a USB cold wallet, as shown in Figure 2-10.

Chapter 2-2 - The Blockchain Features of Bitcoin

As the first blockchain project, Bitcoin’s unique features have provided significant inspiration for the development of blockchain technology. These features include decentralization, security, anonymity, transparency, traceability, and immutability.

● Decentralization

One of Bitcoin's core features. Traditional currency systems rely on central banks and financial institutions to issue currency and maintain transaction records, with the central bank acting as a centralized authority during financial transactions, as shown in Figure 2-11. In contrast, Bitcoin uses peer-to-peer (P2P) technology to eliminate centralized control. Transactions are processed and recorded by numerous (miner) nodes, which then broadcast the updated ledger to all nodes, as shown in Figure 2-12. The decentralized nature of Bitcoin enhances its security, as its blockchain copies are distributed across many nodes worldwide. For an attacker to control the network, they would need to control over 51% of the total computing power—a feat that becomes nearly impossible as the network grows. Thus, Bitcoin is considered a highly secure digital currency system.

Figure 2-11, Processing Flow of Fiat Currency Transactions

Figure 2-12, Processing Flow of Cryptocurrency Transactions

● Security

Bitcoin’s security relies on its underlying encryption technology (SHA-256) and its Consensus Protocols (Proof of Work, PoW) [Note. 2] to ensure privacy and security. Bitcoin transactions are secured by these technologies, ensuring the legitimacy and irreversibility of each transaction. Each Bitcoin address is generated using a public and private key pair, and only the person holding the private key [Note. 3] can access and manage the funds, ensuring user asset safety.

Bitcoin uses SHA-256 (Secure Hash Algorithm 256-bit) as a one-way cryptographic hash function. SHA-256 converts data of any length into a fixed 256-bit (32-byte) hash value. Even minor changes in the input data will produce a completely different hash value, making the system highly secure and irreversible.

In addition to encryption technology, Bitcoin’s network is supported by the PoW Consensus Protocols, which involves solving complex mathematical problems to secure the right to record transactions. This process requires significant computational resources and energy, making network attacks difficult and costly, while preventing fraud, such as double-spending.

● Anonymity

Anonymity is one of the most attractive features for Bitcoin users. Although transaction records are publicly available on the blockchain, the identities of the parties involved are not revealed. Bitcoin addresses are anonymous, keeping transactions private. This anonymity was one of the reasons Bitcoin was initially popular on dark web marketplaces for illegal activities such as smuggling and money laundering.

However, with the development of blockchain analytics, Bitcoin's anonymity is not absolute. Transactions can still be traced, especially when Bitcoin is converted into fiat currency at exchanges, which enforce KYC (Know Your Customer) regulations. Governments and regulatory agencies are working to strike a balance between protecting user privacy and preventing illegal activities.

● Transparency and Tracking

Bitcoin’s blockchain network is completely transparent. Anyone can view detailed information about each block on blockchain explorer websites, as shown in Figure 2-13. Each block contains transaction details, including block hash, height, transaction fees, and the miner who secured the block. The transactions conducted within a 10-minute block are also available for review. For instance, by inspecting the address 14dJR…piXyn, one can see how many bitcoins it holds, its transaction history, and the addresses of bitcoin senders and recipients. This transparency allows anyone to trace transaction history down to the smallest details.

Figure 2-13, Bitcoin Blockchain Information

● Immutability

One of the major advantages of Bitcoin’s blockchain technology. Each block in the chain contains the hash of the previous block, making it extremely difficult to alter any past transactions. To modify a transaction in one block, the attacker would need to recalculate the hash for that block and all subsequent blocks, and then gain control of more than 51% of the decentralized network to have the changes accepted.

Bitcoin’s immutability relies on the 51% attack rule and the prevention of double-spending attacks. A 51% attack occurs when an attacker gains control of more than 51% of the network’s computing power, enabling them to alter transaction history or halt new transactions. A double-spending attack occurs when an individual attempts to spend the same digital currency twice. However, in reality, coordinating such an attack is nearly impossible, making Bitcoin’s blockchain a highly secure and tamper-resistant ledger.

Chapter 3 - The Accounting Principles of Bitcoin Mining

This chapter provides an in-depth look into the structure and rules of Bitcoin, followed by a comparison between gold mining and Bitcoin mining, and an analysis of their historical development. It concludes with a discussion on Bitcoin Explorer, offering insights into the global mining dynamics of the Bitcoin network.

Chapter 3-1 - Bitcoin's Structure and Rules

The Bitcoin network is a decentralized system composed of multiple layers, with operational mechanisms that differ significantly from traditional financial systems. The key components of this network include:

1. Basic Bitcoin Rules: At the time of creation, the total supply of Bitcoin was capped at 21 million coins, and each BTC can be divided into eight decimal places (0.000 000 01 BTC), with the smallest unit known as "Satoshi." Each block is generated approximately every 10 minutes, but this time is dynamically adjusted every two weeks based on the global network difficulty. Mining nodes compete for the right to record transactions and receive block rewards, as shown in Figure 3-1. Block rewards are halved every 210,000 blocks, starting from 50 BTC and continuing to halve until 0 BTC is eventually mined in 2140.

Figure 3-1, Bitcoin Difficulty Adjustment Information

2. Mining Equipment (Nodes): The Bitcoin network relies on globally distributed nodes, which are computing devices (miners) running Bitcoin software. These nodes participate in finding the nonce, verifying transactions, and receiving block rewards. The computing devices have evolved from early personal CPU computers, to GPU setups, FPGA (Field-Programmable Gate Array) devices, and finally, specialized ASIC (Application-Specific Integrated Circuit) miners, constantly increasing computational power (hash rate).

3. Blockchain and Proof of Work (PoW): The Bitcoin blockchain continuously generates new blocks to record transactions. Each block links to the previous one, forming a chain. New blocks are created when nodes (miners) solve complex mathematical problems by finding a nonce that satisfies specific hash conditions, then broadcasting it to the network for validation by other nodes. Once validated, the new block and its transactions are added to the blockchain, and the miner who solved the problem is rewarded. This process is known as Proof of Work (PoW).

A simple analogy is a classroom full of students working on a math problem. One student suddenly shouts, "I solved it!" and the others verify the solution. If correct, everyone celebrates, and the student receives a reward, as shown in Figure 3-2.

Figure 3-2, Visualization of Solving Nonce in Blockchain

4. Halving: When a miner wins the right to record transactions and validates a block, they receive block rewards, and a new block is generated. Every time 210,000 blocks are produced, the block reward is halved, starting from 50 BTC, then 25 BTC, 12.5 BTC, 6.25 BTC, and eventually down to 0 BTC. This process is known as "Halving."

5. Distributed Ledger: Bitcoin's blockchain is a decentralized public ledger that records all Bitcoin transactions. Every node maintains a complete copy of the blockchain, ensuring consistency and immutability through Consensus Protocols.

6. Application Layer: This layer enables user interaction with the Bitcoin network through wallets, exchanges, and payment platforms. Users can send and receive Bitcoin for everyday transactions using these applications.

For a better understanding of the entire structure, refer to Figure 3-3. Bitcoin addresses enable borderless transfers, with transactions handled by underlying nodes (miners). Over time, the Bitcoin network has expanded, attracting more contributors (miners) and investors, with mining hardware showing significant improvements in computing power.

Figure 3-3, Diagram of Bitcoin Blockchain Network Structure

Chapter 3-2 - The Evolution of Bitcoin Mining

The discovery of gold in California in 1848 triggered a massive gold rush, attracting locals and foreign immigrants. Mining techniques evolved over time to increase efficiency, giving rise to industries like Levi Strauss & Co., Eagle Manufacturing Company, Wells Fargo & Company, and many others, as shown in Figure 3-4. The development of Bitcoin mining can be compared to the historical framework of the Gold Rush.

As shown in Figure 3-5, Bitcoin mining technology has evolved significantly. In the early days, miners used CPUs to find the nonce, with hash rate around 450H/s [Note. 4]. In 2010, miners switched to GPUs, increasing hash rate to 25MH/s. By 2011, FPGA technology further boosted hash rate to 1.5 GH/s. However, the introduction of ASIC miners by Bitmain in 2013, starting with the Antminer S1 (180 GH/s), dramatically increased mining efficiency, with a 530x difference in computing power compared to FPGA. This marked the rapid expansion of the Bitcoin mining industry.

With the rise of ASIC miners, large-scale mining farms began to emerge, creating clusters of mining hardware known as "farms." When multiple miners pool their resources, it forms a "mining pool." China's first Bitcoin mining pool, F2Pool, was established in April 2013, followed by Bitmain's AntPool in 2014. Other notable mining pools include ViaBTC, Foundry USA, Binance Pool, and SpiderPool.

From 2013 onward, Bitcoin mining evolved into a mix of individual and enterprise participation. However, with each halving event and changes in national policies, low-efficiency, high-cost, and illegal mining operations were gradually phased out, leading to an increasingly professional, competitive, and integrated industry. By 2020, after the halving, the mining industry had consolidated into a space dominated by large mining companies with significant capital, high efficiency, and low costs, as shown in Figure 3-6. From my own mining experience between 2016 and 2020, I noticed a shift from individual miners to collaborative mining alliances. Individual computing resources were added to mining pools, where rewards were distributed according to contributed hash rate.

In 2020, Chinese miners contributed over 71% of the global hash rate, thanks to low costs and loose regulations. However, in May 2021, the Chinese government announced a crackdown on Bitcoin mining and trading, revoking licenses and cutting power to mining facilities. Within a month, 90% of Chinese miners ceased operations. By September 2021, China declared cryptocurrency-related activities illegal, categorizing Bitcoin mining as an "eliminated industry." This forced miners to relocate to countries like the U.S., Russia, Canada, Kazakhstan, and Ethiopia, where low costs and favorable regulations made mining viable. Some Chinese miners established operations in at least 12 U.S. states, including Arkansas, Ohio, Oklahoma, Tennessee, Texas, and Wyoming.

Following China’s ban, many U.S. mining companies went public, such as Marathon Digital Holdings (MARA), CleanSpark Inc. (CLSK), and Cipher Mining Inc. (CIFR). European and Canadian mining companies, like Core Scientific, Cipher Mining, and Iris Energy, also flourished. Even governments, such as Ethiopia, El Salvador, Venezuela, Russia, and Kazakhstan, utilized their natural resources to generate low-cost electricity for mining. These nations are typically resource-dependent and vulnerable to currency fluctuations, especially when the U.S. dollar strengthens, increasing debt repayment costs, reducing foreign exchange earnings, and causing inflation.

To alleviate economic pressure, El Salvador adopted Bitcoin as legal tender in June 2021, becoming the first Bitcoin-based economy. This policy allowed 70% of its unbanked citizens to access financial services via mobile phones, reducing remittance costs for those working abroad. On a national level, it decreased reliance on the U.S. dollar, increased monetary sovereignty, and boosted economic flexibility. Following El Salvador’s lead, the Central African Republic adopted Bitcoin as legal tender in Q2 2022.

Figure 3-4, The Evolution of Gold and Bitcoin Mining

Figure 3-5, Changes in Mining Equipment and Scale

Figure 3-6, Evolution of the Mining Community Over the Years

Chapter 3-3 - Analyzing Global Mining Data Through Bitcoin Explorer

This chapter delves into the interpretation of data provided by Bitcoin explorers, such as BTC.com, and connects it with the foundational knowledge from previous sections. Currently, there are many Bitcoin explorer resources available, such as BTC.com, Blockchain.com, Tokenview, OKX and blockchair. Here, we will focus on BTC.com as an example. The principles discussed here apply to any cryptocurrency that uses mining, as their operational rules are similar to Bitcoin's.

Upon entering BTC.com, you can view key metrics such as Bitcoin's market cap, circulating supply, remaining supply to be mined, network status, and mining pools, as shown in Figure 3-7.

Figure 3-7, BTC Explorer Basic Information

As seen in Figure 3-8 (refer to Figure 2-13 for supplementary understanding), the left side of the network status section provides important data points, which include hash rate, difficulty, earnings per unit of hash rate, expected next difficulty adjustment, and the ratio of fee reward to block reward.

● Hash Rate: This refers to the computational power of a mining machine. The hash rate indicates how many hashes (computations) can be performed per second, with the base unit being Tera Hashes per second (TH/s). Mining involves finding a nonce and calculating the block hash using the SHA-256 hashing algorithm. The collective hash rate of all mining machines reflects the total network hash rate, e.g., 558.12 EH/s = 558,120 PH/s = 558,120,000 TH/s.

● Difficulty: Bitcoin's network is designed to generate a new block every 10 minutes. After 2,016 blocks (about 14 days), the difficulty adjusts based on the total mining power. If blocks are produced faster than 14 days, the difficulty increases; if slower, the difficulty decreases.

● Expected Next Difficulty: This shows how the next difficulty adjustment will change based on the total time taken to mine the last 2,016 blocks(2,016 blocks x 10 mins = 20,160 mins). The goal is to keep block production at an average of 10 minutes per block. The adjustment formula ensures the new difficulty maintains this timing:

New Difficulty = Old Difficulty × (20160 minutes / Time taken for last 2016 blocks)

Example: If it took 12 days (17,280 mins) to mine the last 2,016 blocks, the new difficulty will increase by 16.67%. If it took 16 days (23,040 mins), the difficulty will decrease by 12.5%.

● Date to Next Difficulty: This indicates when the next difficulty adjustment will occur, based on current mining speeds, but the theory time is 14 days.(2,016 blocks x 10 mins / 1,440 mins = 14 days)

● Earnings per Unit (Earning/T): This shows the daily earnings per unit of hash rate (TH/s). Many small miners join mining pools to combine their computing power. Common reward models include:

Pay-Per-Share (PPS): Miners are paid a fixed amount based on the valid shares they contribute, regardless of whether the pool finds a block.

Full Pay-Per-Share (FPPS): An improved version of PPS that also includes a share of transaction fees.

● Fee Reward/Block Reward Ratio: This shows the ratio of transaction fees to block rewards. As the block reward decreases over time (due to halving), the significance of transaction fees increases. By 2140, when all Bitcoin has been mined, transaction fees will be the sole reward for miners.

Figure 2-13, Bitcoin Blockchain Information

Figure 3-8, BTC Explorer Network Status

The right side of Figure 3-9 displays information on mining pools, including their real-time hash rate, network share, 7-day luck, blocks mined, and average transaction fees per block. By selecting a specific mining pool, such as Foundry USA, you can view additional details such as the number of blocks mined daily and block-specific information (block height, rewards, hash, and transactions), as shown in Figures 3-10 and 3-11.

Figure 3-9, BTC Explorer Mining Pool Information

● Network Share: This shows the proportion of the total network hash rate contributed by a particular mining pool.

● 7-Day Luck: This metric compares the actual number of blocks found by a pool over a week to the expected number based on the pool’s hash rate. A value of 100% means the pool found the exact number of blocks expected; values above or below indicate better or worse luck, respectively.

Example: As of June 27, 2024, Foundry USA has 27.44% of the network hash rate. With 144 blocks mined daily, Foundry USA is expected to find 39.51 blocks per day (144 × 27.44%), or 276.59 blocks over 7 days. If they found 254 blocks, their 7-day luck would be 91.83%.

● Blocks Mined: This shows the number of blocks mined since the last halving.

● Average Transaction Fee per Block: This shows the total transaction fees collected in a block, distributed to the miner who finds it.

● Blocks List: This section provides detailed information about the blocks mined by a particular pool. It includes the block height (the sequential number of the block), block reward (how much Bitcoin was rewarded for mining the block), hash value (the unique cryptographic hash of the block), and detailed information about each transaction contained in the block, as illustrated in Figure 3-12.

The BTC Explorer provides a real-time snapshot of global mining activity, offering insights into key metrics like network difficulty, hash rate, and pool performance. This data is invaluable for calculating mining costs, which will be covered in the next chapter.

Figure 3-10, Foundry USA 7-Day Luck Calculation

Figure 3-11, Block Mining Pool Information

Figure 3-12, Block Information

Chapter 4 - Comparative Analysis of Bitcoin and Various Assets

In this chapter, I will conduct a detailed comparison of Bitcoin and gold from an asset perspective, analyzing their similarities and differences. By using gold as a baseline, we will explore whether Bitcoin shares the same properties and what similar developmental potential it may have. I will also compare Bitcoin spot markets with Bitcoin ETFs, evaluate their respective features, and propose investment strategies tailored to different needs. Finally, I will review companies and enterprises that have invested in Bitcoin in recent years to understand the institutional acceptance and popularity of Bitcoin among institutional investors. Through this comparative analysis, we aim to provide a comprehensive understanding of Bitcoin's current position and future potential.

Chapter 4-1 - Bitcoin vs. Gold

Bitcoin and gold, as two influential assets in today’s market, have key characteristics in common, particularly their anti-inflationary properties. As seen in Figure 4-1, gold has historically been a reliable store of value, especially during periods of economic instability, due to its scarcity and safe-haven status. Similarly, Bitcoin, with its capped supply of 21 million coins, is increasingly regarded as "digital gold." This fixed supply ensures Bitcoin’s rarity and makes it a strong asset for value retention, particularly as inflationary pressures mount with the continual printing of fiat currency.

Figure 4-1, Bitcoin vs. Gold

Gold mining is constrained by natural resources and technology, while Bitcoin's supply is clearly defined by its whitepaper. As of now, approximately 197,576 tons of gold have been mined, while 19,718,021.88 BTC have been mined, representing 93.8% of the total supply. This transparency makes it easier to estimate Bitcoin's mining costs and market value.

In terms of usage, gold and Bitcoin share similarities but also have significant differences. Gold has long been widely used as an investment and safe-haven asset, particularly during times of economic instability. Its stability and risk-hedging capabilities make it a vital tool for preserving wealth. However, one of its biggest drawbacks is its physical weight. This makes transporting gold cumbersome. The best approach is to carry gold to another region or country and exchange it for the local currency. However, there is a complication: transporting more than 2kg of gold or the equivalent of $20,000 out of the country typically requires a declaration and obtaining a permit. Failure to comply with these regulations may result in fines, confiscation, or other penalties.

Both Bitcoin and gold have similarities and differences in terms of use cases. Gold has been used as an investment and safe-haven asset for centuries, especially during economic downturns. However, its physical weight makes it cumbersome for transportation. In comparison, Bitcoin's digital nature makes it more versatile in global cross-border payments, with its decentralized and anonymous features offering advantages in digital transactions.

Observing the difference between 2024 and 2018, we see significant progress. Multiple cycles of bull and bear markets in Bitcoin have produced many crypto millionaires. However, many crypto assets (BTC, ETH, USDT) are still not fully integrated into formal financial systems, limiting their liquidity into fiat currencies, goods, and services. This has led to cycles of sharp price appreciation within the crypto market.

More companies are now accepting Bitcoin as a form of payment, making it increasingly easier for crypto holders to utilize their digital assets. Some examples include:

1. Payment ways in El Salvador: Children in El Salvador using Bitcoin's Lightning Network to buy snacks. (Video link)

2. Bitcoin ATMs: Companies like K1 Technology in El Salvador are manufacturing Bitcoin ATMs (K1 Mini), allowing users to exchange Bitcoin for goods and services. (Video link)

3. Brazil education: Educational programs are teaching children how to use Bitcoin for payments, shaping future consumption trends. (Video link)

4. Payment ways in Germany: Bitcoin is being used to pay for beer in Germany, showcasing growing acceptance in Europe. (Video link)

5. Pay taxes by cryptocurrencies in Switzerland: As of 2022, Bitcoin and USDT are accepted as legal tender in Lugano, Switzerland, where citizens can pay for taxes, fines, and more with crypto. The driving force behind this initiative is Tether, the stablecoin issuer, in collaboration with the city of Lugano, through the launch of the Plan B initiative. The goal of this plan is to transform Lugano into the "Bitcoin Capital of Europe." Currently, over 200 stores and businesses in the city accept cryptocurrency payments, and more than 15% of the residents use the Swiss Franc stablecoin (LVGA) for everyday transactions. From McDonald's to century-old local shops, Bitcoin is increasingly accepted as a form of payment. This move indicates that cryptocurrency is steadily becoming a mainstream payment method in Europe.

6. Buy real estate by cryptocurrencies in Taiwan: Bitcoin is increasingly accepted in real estate transactions, indicating rising recognition of Bitcoin's value. See Figures 4-2 and 4-3 for examples of real estate listings in Taiwan accepting BTC, ETH, USDT.

Figures 4-2, Taiwan Real Estate Accepting Bitcoin Payments(2018)

Figures 4-3, Taiwan Real Estate Accepting Bitcoin Payments(2023)

7. Global Adoption: According to BTC Map , verified businesses globally are accepting Bitcoin payments. As of July 2024, Europe, Central and South America, and parts of the U.S. are leading in Bitcoin adoption.

8. Shopping Mall of Japan accept Bitcoin payments: During my travels in Japan in 2024, I discovered that even large retailers like Bic Camera accept Bitcoin as shown in Figure 4-5.

Figures 4-4, Global Businesses Accepting Bitcoin

Figures 4-5, Shopping Mall of Japan accept Bitcoin payments

9. Luxury Cars accepting Bitcoin payments: Ferrari began accepting BTC, ETH, and USDC with BitPay in 2023 for car purchases in the U.S., with plans to expand to Europe and globally by the end of 2024 as shown in Figure 4-6.

Figure 4-6, Ferrari accepting Cryptocurrencies payments

10. Cryptocurrencies payments in Travel Industry: Bitcoin is now widely accepted for travel-related expenses, including flights, accommodations, and activities as shown in Figure 4-7.

Figure 4-7, Cryptocurrencies payments in Travel Industry

In the financial market, gold spot ETFs have been available since their launch on November 18, 2003. Within eight years (by August 11, 2011), the price of gold ETFs surged by 398.38%. As of May 1, 2024, the total increase since their launch is 532.13%, indicating strong demand and recognition from investors. This has made gold ETFs a popular choice for those seeking a safe haven and long-term value appreciation. Given the similar scarcity and safe-haven attributes of Bitcoin and gold, both Bitcoin ETFs and gold ETFs can be analyzed together to evaluate Bitcoin ETFs’ potential development, as shown in Figure 4-8.

When gold ETFs were first introduced in 2003, the market value of gold was around $1 trillion. Over the following 20 years, the market experienced a series of global events such as the financial crisis, the European debt crisis, oil price crashes, Brexit, the COVID-19 pandemic, supply chain disruptions, and the Russia-Ukraine war. By 2024, the market value of gold had risen to $12 trillion. Bitcoin ETFs, launched on January 11, 2024, show strong potential despite their relatively short time on the market. Interestingly, at the time of the Bitcoin ETF launch (June 2024), Bitcoin's market value was also approximately $1 trillion. If we project future growth based on the early expansion of the gold ETF market, it is plausible that Bitcoin's market value could similarly rise to over $12 trillion in the coming years, as shown in Figure 4-9. Bitcoin spot ETFs could replicate the growth pattern of gold spot ETFs.

As the global financial market continues to evolve, investor acceptance and demand for these new assets will likely keep growing, positioning Bitcoin as an increasingly important player in the future financial ecosystem. The introduction of Bitcoin spot ETFs marks the entry of cryptocurrency into mainstream investment. Given technological advancements, the expansion of fiat money supplies, and the growing debt burdens worldwide, Bitcoin spot ETFs are expected to experience significant growth, potentially becoming the next major asset class. This would attract more investors and capital, further solidifying Bitcoin's role in the financial market.

Figure 4-8, Gold ETF Performance

Chapter 4-2 - Bitcoin Spot V.S. Bitcoin ETF

In this chapter, I will compare the differences and similarities between Bitcoin spot and Bitcoin ETFs, as illustrated in Figure 4-10. Below is an analysis of key points regarding their commonalities and differences:

1. Similarities: Both are assets for value storage, and losing Bitcoin likely results in loss.

● Value Storage Asset: Both Bitcoin spot and ETFs can be used for value storage and asset appreciation. Holding either offers a similar purpose, and with ETFs, the issue of premium and discount has been largely resolved. Before the approval of Bitcoin ETFs, the only direct product linked to Bitcoin spot was the Grayscale Bitcoin Trust (GBTC), which exhibited significant price deviations, with a premium of 43.21% and a discount of 48.89%. The rate of return for investors holding GBTC was impacted by these deviations. However, after the approval of Bitcoin ETFs, the free flow of capital has led to a gradual elimination of such premiums and discounts, as shown in Figure 4-11.

● Risk of Loss: Whether holding Bitcoin spot or ETFs, if the worst-case scenario occurs (theft, loss, etc.), the investor would need to absorb the loss. Spot Bitcoin holders might store assets on exchanges for convenience, which exposes them to risks like insider fraud, theft, security breaches, and hacking. Assets in this case would be irretrievably lost. If stored in cold wallets, losing the seed phrase also means a total loss of assets. On the other hand, holding ETFs also carries risks. For instance, BlackRock’s S-1 filing with the SEC highlights potential risks, stating that Coinbase Global maintains a $320 million insurance policy for client asset losses, but this coverage is shared among all clients and may not cover every loss or be sufficient for all events. Importantly, unlike bank deposits, Bitcoin is not insured by FDIC or SIPC, meaning any loss, including loss of private keys, will not be compensated. Therefore, both spot and ETF holders must be prepared for such risks.

2. Differences: Payment, storage, taxation, trading barriers, and ownership rights.

● Payment: Bitcoin spot offers equity, ownership, and transaction rights. It can be used directly as a medium of exchange for goods and services and has value growth potential similar to stock ownership.

● Ownership Rights: In the next decade, Bitcoin may be recognized as a formal asset. In 2024, the Financial Accounting Standards Board (FASB) (https://aboutblaw.com/bbR6) introduced new guidelines requiring businesses holding cryptocurrencies like Bitcoin and Ethereum to report them at fair value, reflecting gains and losses in net income. This rule will take effect on December 15, 2024, for both public and private companies, indicating a shift towards recognizing Bitcoin as a financial asset with ownership rights. Bitcoin ETFs, on the other hand, are securitized dollar assets, meaning investors only gain capital appreciation from price changes without directly owning the underlying Bitcoin.

● Storage: Bitcoin spot can be stored in cold wallets (offline) or hot wallets (on exchanges), depending on the user’s preference. Bitcoin ETFs, however, are securitized representations of Bitcoin held by custodians like BitGo, Coinbase, or Gemini.

● Taxation: Tax considerations depend on various factors, including location, legal status, and the tax regulations of the country in question. Due to the complexity of legal and tax implications, consulting a professional is recommended.

● Trading Barriers: Purchasing Bitcoin spot requires setting up exchange accounts, linking deposit/withdrawal accounts, establishing cold wallets, and setting up address whitelists. Bitcoin ETFs are much simpler to trade, as they can be bought and sold directly through brokerage accounts.

Figure 4-10, Bitcoin Spot vs. Bitcoin ETF

Figure 4-11, GBTC Premium/Discount

The listing of Bitcoin and Ethereum ETFs on U.S. stock exchanges marks a significant milestone, bridging the gap between traditional fiat and cryptocurrencies. For institutional investors restricted by regulations, security concerns, or unclear regulatory frameworks, direct investments in Bitcoin spot were previously inaccessible. With SEC-approved Bitcoin and Ethereum ETFs, these institutions can now safely invest in the crypto market, leading to a surge in capital flow. The increasing demand for Bitcoin ETFs is expected to drive up the price of spot Bitcoin as the available supply diminishes relative to the massive demand from institutional investors.

Since the approval of Bitcoin ETFs on January 11, 2024, the trend has shifted from retail to institutional dominance. A prime example is BlackRock’s Bitcoin ETF (IBIT), which reached a $20 billion scale in just 144 days by June 3, 2024. When combined with nine other Bitcoin ETFs, the total scale reached approximately $46 billion, as shown in Figure 4-12. HODL15Capital’s data indicates that within six months of Bitcoin ETFs’ launch, issuers collectively acquired 867,532 BTC (valued at $56.3 billion) by June 21, as shown in Figure 4-13. Moreover, the SEC’s Q1 13F reports reveal that 414 institutions hold IBIT, 402 hold GBTC, over 200 hold FBTC, and more than 100 hold BITB (Figure 4-14).

Such massive capital inflows and rapid institutional adoption of new ETFs are unprecedented for any financial product. This implies that the situation for Bitcoin spot holdings is likely even more remarkable, and the next chapter will explore how institutions are positioning themselves with Bitcoin spot holdings.

Figure 4-12, Bitcoin ETF Data (June 29, 2024)

Chapter 4-3 - Institutional and Corporate Adoption of Bitcoin

The chapter will compare the holdings of Bitcoin between commercial companies, private companies, ETFs, and governments based on publicly available data from bitcointreasuries(https://bitcointreasuries.net/). Analyzing this data will provide insights into the potential growth and development of Bitcoin in the near future. As shown in Figure 4-15, we observe significant Bitcoin purchases across commercial companies, ETFs, and governments on three key dates: August 30, 2023, January 3, 2024, and January 29, 2024. After January 29, 2024, there has been continuous accumulation, with ETFs adding 228,301.693 BTC and commercial companies acquiring 49,262.068 BTC. From January 30 to July 3, 2024, daily demand has exceeded production by 2.63x.

Figure 4-15, Bitcointreasuries Data (07/03/2024)

Public Company

Prominent public companies such as MicroStrategy, Marathon Digital Holdings, Riot Platforms, CleanSpark, Cipher Mining, and Bit Digital in the United States; HIVE Digital Technologies and Bitfarms in Canada; and Metaplanet in Japan have recently increased their Bitcoin holdings. MicroStrategy, in particular, has been a trailblazer in this space. Since August 11, 2020, under the leadership of CEO Michael J. Saylor, the company has continuously purchased Bitcoin without pause. MicroStrategy has even issued corporate bonds and convertible bonds to further expand its Bitcoin investment portfolio. Starting with an initial purchase of $250 million in Bitcoin in August 2020, the company has subsequently issued $600 million in convertible bonds in 2021, $1 billion in corporate bonds in 2022, $750 million in corporate bonds in 2023, and $1.2 billion in convertible bonds in 2024. This aggressive acquisition strategy has positioned MicroStrategy as a benchmark for corporate Bitcoin holdings, significantly influencing other companies to follow suit.

This bond-issuing strategy was recently emulated by the Japanese company Metaplanet. Faced with severe depreciation of the Japanese yen due to prolonged low-interest rates, a strong U.S. dollar, and robust economic performance in the United States leading to capital inflows and yen appreciation pressures, Metaplanet issued corporate bonds to raise funds for purchasing Bitcoin. This approach aims to hedge against the asset shrinkage risks posed by the yen's depreciation, leveraging Metaplanet's access to abundant hydroelectric resources and low electricity costs to reduce mining expenses. These factors give Bhutan a competitive edge in cryptocurrency mining, attracting mining companies like Bitmain’s subsidiary Bitdeer for collaborative ventures.

Other companies increasing their Bitcoin holdings are predominantly Bitcoin mining firms. The quantity of Bitcoin these companies hold is estimated to be the net profit from mining block rewards after deducting operational costs. In the cryptocurrency market, Bitcoin mining companies play an increasingly crucial role. They are responsible not only for maintaining the blockchain network’s security but also for financially reinforcing their balance sheets by holding the Bitcoin they mine.

Based on observations from 2024, it is anticipated that more commercial companies will emulate MicroStrategy’s model. Additionally, mining companies are likely to accumulate capital in preparation for the next halving cycle, aiming to expand their operations and outcompete smaller miners.

Private Company

Tether Holdings, the issuer of the USD stablecoin USDT, announced on May 17, 2023, that it would allocate 15% of its net profits for that month (approximately $222 million) to purchase Bitcoin. Furthermore, Tether plans to continue allocating 15% of its net profits each month to increase its Bitcoin holdings while also planning to raise its reserves of gold and U.S. Treasury bonds. This strategy aims to diversify and stabilize its balance sheet by balancing high-risk asset investments with secure assets.

- Massive Bitcoin Purchases by Stablecoin Issuers: Tether’s large-scale Bitcoin acquisitions increase market demand, further driving Bitcoin prices upward.

- Diversified Asset Reserves: By continuously increasing reserves in gold and U.S. Treasury bonds, Tether demonstrates a strategy of balancing risk while expanding its high-risk asset portfolio.

- Hedging Against Inflation and Currency Depreciation: Holding Bitcoin helps Tether combat inflation and currency devaluation issues.

Tether Holdings' increased purchasing power and ongoing Bitcoin accumulation steadily boost market demand, providing strong support for Bitcoin’s price. As a stablecoin issuer, Tether’s asset allocation strategy may influence other financial institutions and investors' perceptions and investment behaviors towards Bitcoin. Tether's actions reflect confidence in Bitcoin’s long-term value, highlighting the growing maturity and diversified investment strategies within the cryptocurrency market. In the future, as more large-scale institutions join Bitcoin’s investment ranks, Bitcoin’s market demand and price are expected to continue rising, further expanding and maturing the cryptocurrency market.

Government

As of 2024, several countries have publicly disclosed their Bitcoin holdings, including developed economies like the United States, United Kingdom, and China, as well as developing nations such as El Salvador, Bhutan, and Venezuela. Below is an analysis based on publicly available information regarding these countries' Bitcoin holdings.

United States, United Kingdom, China:

- The Bitcoin holdings of the United States, the United Kingdom, and China primarily originate from the seizure of illegal assets, which are then turned over to the state following criminal investigations.

- United Kingdom: The UK government primarily acquires Bitcoin through confiscating illicit proceeds. In 2021, the UK seized 61,000 BTC linked to money laundering activities involving Chinese nationals Jian Wen and Zhimin Qian. These Bitcoins were used to purchase substantial real estate and luxury goods across Europe.

- China: There are no explicit reports detailing the Chinese government's Bitcoin holdings. However, it is known that in 2020, the Chinese government seized 190,000 BTC from the PlusToken Ponzi scheme. Additionally, recent crackdowns on illegal mining operations and fraudulent businesses likely resulted in substantial Bitcoin confiscations, though exact figures remain undisclosed. Given the scale of these operations, it is reasonable to infer that China's Bitcoin holdings exceed 190,000 BTC.

El Salvador, Bhutan and Venezuela:

- Bhutan and El Salvador primarily acquire Bitcoin through government-led mining operations.

- El Salvador: Following the declaration of Bitcoin as legal tender in June 2021, El Salvador has undertaken several measures to increase its Bitcoin reserves. This includes establishing Bitcoin banks, utilizing geothermal resources for mining, and implementing a daily Bitcoin investment plan starting March 16, 2024, where the country invests in Bitcoin daily. These initiatives enhance El Salvador’s Bitcoin reserves and increase public awareness and usage of Bitcoin among its citizens.

- Bhutan: Bhutan leverages its national strength to promote the Bitcoin industry. The country’s sovereign investment institutions have been engaged in Bitcoin mining for years, utilizing abundant hydroelectric power resources to achieve low electricity costs. The favorable mountainous climate further reduces mining expenses, attracting mining enterprises such as Bitmain’s subsidiary Bitdeer for collaborative projects.

- Venezuela: Information on Venezuela’s Bitcoin holdings primarily comes from bitcointreasuries.net. On May 20, 2024, Venezuela’s Ministry of Power and the national power company initiated a special project targeting cryptocurrency mining to address the energy crisis. This project aimed to disconnect mining farms from the national power grid and seize 11,000 mining rigs. It remains unclear whether the seized Bitcoin earnings were also confiscated. Venezuela’s dire economic conditions, with an annual inflation rate of approximately 1,700,000% in 2018, underscore the necessity for alternative currencies like Bitcoin to combat hyperinflation and currency devaluation. Economist Carlos Hernández aptly noted, "In a country facing economic collapse and fiscal corruption, a 'borderless currency' is no longer just a popular slogan," highlighting Bitcoin’s critical role in such environments.

In developed economies or those with strong currencies, Bitcoin typically enters through the confiscation of illicit gains. In contrast, developing countries or those with weak or corrupt currencies face severe economic challenges, extreme currency fluctuations, and hyperinflation, making Bitcoin an essential tool for wealth preservation and risk hedging. These countries adopt various Bitcoin strategies, such as leveraging local advantages for mining, changing legal tender to Bitcoin, and enhancing public awareness of borderless currencies. This reflects the diverse applications and growing importance of cryptocurrencies.

Fund

As depicted in Figure 4-17, after the listing of Bitcoin ETFs, institutional investors and commercial companies primarily hold Bitcoin indirectly through ETFs such as iShares Bitcoin Trust (IBIT), Fidelity Wise Origin Bitcoin Fund (FBTC), ARK 21Shares Bitcoin ETF (ARKB), and Bitwise Bitcoin ETF (BITB). Institutions that previously held the Grayscale Bitcoin Trust (GBTC) have largely sold off their holdings in GBTC and transitioned to other ETFs post-ETF approval.

Initially, traditional fiat investors lacked suitable avenues for Bitcoin investment, with GBTC being the only option. However, between 2021 and 2023, several events eroded GBTC’s reputation and trust, leading to significant premiums and discounts (as shown in Figure 4-9). Additionally, operational disputes (e.g., between Digital Currency Group (DCG) and Grayscale over the sale of $1.6 billion in GBTC shares to repay creditors), liquidity constraints (GBTC investors could not redeem shares freely before conversion to ETFs, causing significant price discrepancies relative to GBTC’s net asset value (NAV)), and high fees (ETF application fees reduced from 2% to 1.5%) led to a continuous sell-off by clients post-ETF listing. Investors shifted towards lower-fee, higher-liquidity, and asset-value-aligned products like IBIT, FBTC, ARKB, and other mainstream ETFs, as depicted in Figure 4-14.

From the 13F reports, it is evident that mainstream Bitcoin ETF holders include asset management firms (Aristeia Capital, Graham Capital Management, Ovata Capital Management, Hightower, Fortress Investment Group, Yong Rong Asset Management, Legacy Wealth Asset Management, Monolith Management, Newbridge Financial Services Group), quantitative trading firms (Susquehanna International Group), hedge funds (Bracebridge Capital, IvyRock Asset Management), hedge fund managers (Boothbay Fund Management, Crcm), investment advisory firms (Cambridge Investment Research, Pine Ridge Advisers, United Capital Management, Sequoia Financial Advisors, Integrated Advisors, Brown Advisory), banks (Morgan Stanley, South State Bank, The Bank of New York Mellon, BNP Paribas), and family offices (Quattro Financial Advisors). This wide array of institutional participation indicates that the financial industry is actively integrating blockchain-based risk assets. Future increases in scale and volume will be a key area of focus.

Figure 4-17: Bitcoin ETF Net Flows, Market Share Comparison

Chapter 4-4 - My Views and Usage of Bitcoin Assets

The value of Bitcoin is increasingly being recognized as on par with fiat currency, and its use in transactions is being accepted by more individuals and businesses alike. Bitcoin is not only used for trading, storing, and appreciating value but also for collateralized lending, depending on how holders view the asset.

In 2024, the main categories of personal consumption—such as food, clothing, housing, transportation, education, and leisure—can all be paid for using digital currencies, provided that both parties agree to the transaction. More companies are also adopting Bitcoin lightning payments, making it easier and faster for merchants to receive payments. Tesla once offered Bitcoin as a payment option for purchasing vehicles, and some UK real estate companies have also accepted Bitcoin for property transactions. These examples show that major purchase categories like real estate, vehicles, and travel can now be paid for using Bitcoin or other cryptocurrencies. Notably, in financial hubs like Switzerland, it is already possible to pay taxes using cryptocurrencies, a significant step toward integrating digital currencies into everyday economic activities.

This wave of adoption is driving demand for Bitcoin, showing that cryptocurrencies will play a critical role in future economic activities. As technology advances and fiat currencies continue to expand in supply, the application scenarios for Bitcoin and other cryptocurrencies will become even broader. The future of these digital assets looks undeniably promising.

From a personal perspective, I view Bitcoin as both a payment tool and a means of preserving wealth. I aim to accumulate as much Bitcoin as possible within my financial capacity. When making significant purchases, particularly assets, I consider using Bitcoin for payment. As global acceptance of cryptocurrencies increases, I believe Bitcoin will be used in a growing number of areas. If Bitcoin can be treated similarly to tangible assets like vehicles and real estate, I plan to integrate its use into my daily life. This reflects my perspective on Bitcoin and cryptocurrency assets, and I look forward to seeing more innovative applications of Bitcoin in various sectors in the future.

The follow-up content is paid content, which is briefly mentioned here. Welcome to purchase paid content.

Chapter 5 - BTC Cycles and Price Range Estimations

Chapter 5-1 - The AB Laws for Bitcoin Price Fluctuations

By thinking from the perspective of "first principles," we can analyze the nature of Bitcoin and the reasons behind its price fluctuations. Before diving into the analysis, we first calculate the current supply and the liquid supply. Then, we divide Bitcoin’s nature into two main factors and explore the sub-factors that drive price changes.

Current BTC Supply Overview

BTC Price Driving

Chapter 5-1-1 - Energy Production Costs

When exploring Bitcoin’s energy costs, I compare the process of mining gold to the generation of Bitcoin. Both require significant resource input. Gold involves drilling, excavation, and refinement, while Bitcoin relies on computational power, electricity, and infrastructure. By applying the concepts of Bitcoin’s "energy value" and "mining cost calculations," I aim to evaluate Bitcoin’s market price and its future trends.

● Energy Value

To estimate Bitcoin's theoretical value, I refer to literature that calculates energy input during the mining process and the Bitcoin supply growth rate. Based on these estimates, the current theoretical value of Bitcoin is approximately $64,448 per coin.

● Mining Cost Calculation

In terms of mining costs, I consider real-world expenses involved in setting up a mining operation, particularly focusing on costs in Taiwan. I designed an Excel sheet that automatically calculates mining expenses based on my previous experience in Bitcoin mining, breaking down costs such as factory construction, equipment, electricity, and personnel. According to these calculations, hardware equipment costs account for X%, electricity for Y% (81%), and personnel costs are only Z%.

Electricity costs significantly impact the overall cost of mining. To account for global mining environments, I incorporated data from sources such as GlobalPetrolPrices, U.S. Bureau of Labor Statistics, and Arcadis, which provide electricity rates, construction costs, and personnel costs across various countries and regions. Using Taiwan as a baseline, I adjust these costs proportionally by region to more accurately reflect real expenses. Finally, these calculations are unitized to present the mining cost per unit (per TH per day).

Based on the final calculations, and in conjunction with Bitmain’s 2024 report on the top-selling mining machines (Antminer S19XP, S21), the current mining cost is estimated to be between $52,000 and $57,500 per Bitcoin.

Comparison of Electricity Rates, Construction Costs, and Personnel Costs Across Different Countries and Regions

Chapter 5-1-2 - The AB Law

As miners lose their influence over Bitcoin's price volatility and their impact diminishes with each halving event, future large-scale price increases will no longer be driven solely by miners. By 2032, when Bitcoin's supply reaches 99.2%, the market's volatility is expected to be controlled by other key groups. Once consensus and adoption increase, Bitcoin's price is likely to rise rapidly. Over the three halving cycles, the distribution of Bitcoin has become increasingly concentrated in the hands of those groups. With Bitcoin currently priced at $60,000 per coin, investors who have yet to buy may find themselves even further behind when prices reach $500,000 per coin.

BTC Price Driving

Bitcoin Distribution (Source: bitinfocharts)

Chapter 5-1-3 - Purchasing Power of Fiat Currencies

The continuous increase in the money supply not only weakens the purchasing power of fiat currencies but also drives up overall price levels, exacerbating inflation. People with limited financial literacy tend to hold cash as a safe option, but they fail to realize that this safety is like holding onto a melting ice cube—its value diminishes over time. Those with higher financial literacy, on the other hand, take full advantage of low-interest environments by leveraging their cash into appreciating assets such as stocks, real estate, bonds, gold, and even Bitcoin. These assets not only preserve value but also help hedge against inflation, further widening the wealth gap.

At the same time, the U.S. debt clock shows real-time data illustrating how the future is being over-leveraged. With the purchasing power of fiat currencies steadily declining, it is worth considering which assets will be the best long-term choices for holding in the future.

US Debt Clock

Chapter 5-2 - The Reproducibility of Bitcoin Cycles

In this chapter, we’ll examine whether Bitcoin’s past price trends show any repeatable cycles. If we can confirm that there is a repeating pattern, we can then use this pattern to identify and respond to potential high and low price points.

Chapter 5-3 - Estimating Bitcoin's Price Increase Threshold

In analyzing Bitcoin's cyclical patterns, valuation models can be used to estimate a reasonable price range and timeframe for Bitcoin. By considering investor behavior and sentiment, these models help identify optimal entry and exit points. After thorough research and evaluation, I have adopted four main models to forecast Bitcoin’s price movements, estimating the timeframes and price ranges within which the coin is expected to rise or fall. These models also take into account the political, economic, and investor group behaviors and sentiments to provide a comprehensive analysis.

During bull and bear market phases, I apply 4 to 6 supplementary signals to enhance the accuracy of these predictions, ensuring a more precise judgment.

Using Valuation Models and Data to Identify Bitcoin’s Cyclical Patterns and Key Price Levels

Chapter 5-4 - Estimating Bitcoin's Price Decrease Threshold

Here, we calculate the cost of mining by breaking down all expenses, including hardware setup (land costs, factory construction, power distribution, miner installation, air conditioning), electricity costs (miners, air conditioning, other electricity needs), and labor costs. We then calculate how many miners can be installed in the factory and how much Bitcoin they can produce (revenue). Ultimately, this gives us the equivalent cost per hash rate, per unit of electricity, per day.