Jul. 15, 2020 3:34 AM ET14 comments | 23 Likes by: The FALCON Method

Summary

Starbucks has posted outstanding organic growth throughout the years with further catalysts from emerging markets and digitalization.

The company has been rewarding its shareholders with years of dividend growth and significant share repurchases.

Starbucks might be fairly valued today, but let’s see what price we would need to call it an absolute bargain.

Written by the FALCON Team

Introduction

Just recently, we published our monthly shortlist of companies passing our rigorous 3-step stock selection process exclusive for Seeking Alpha readers. After our recent article on one of the largest publicly traded healthcare companies, Amgen (AMGN), we now take a look at the world’s most popular coffee chain to show what it would take for us to initiate a position in an exceptional brand name like Starbucks (SBUX).

In light of Buffett’s teachings distilled from his 50+ years of shareholder letters, our analysis is based on the three dimensions that truly matter: operations, capital allocation and valuation. But before we do that, let’s jump into what makes Starbucks an interesting candidate today

So, what’s the story with Starbucks?

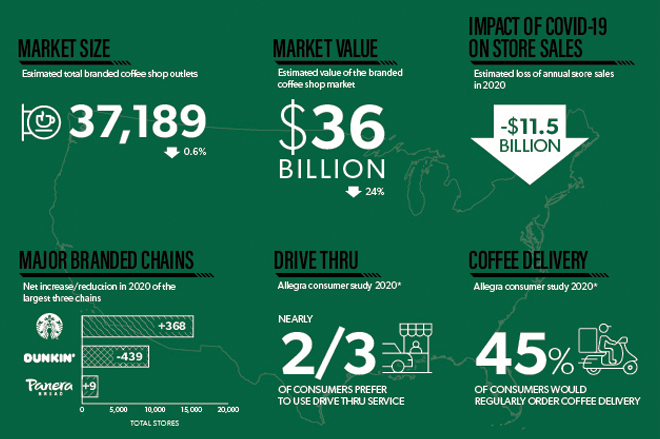

Starbucks, with over 32,000 stores around the globe, is the premier roaster and retailer of specialty coffee in the world. Given the company’s retail-based business, it is key to address the effects of COVID-19. The pandemic has had a significant impact on Starbucks around the globe, resulting in severe comparable store sales declines YoY in two of its biggest markets: -78% in China (in February) and -63% in the U.S. (in April).

While these numbers improved by the end of May (with -14% in China and -32% in the U.S.), limited operations with increased payments via the company’s app also allowed Starbucks to get more data on its customers. There are 19.4 million Starbucks Rewards members, a 15% increase YoY, who actively use the app, and over 80% of customer orders were “on-the-go” in the U.S. even before COVID-19.

Due to changing customer behavior, management decided to accelerate the previously planned portfolio optimization in the United States. Over the next 18 months, the company will increase convenience-led store formats with drive-thru and curbside pickup options, as well as Starbucks Pickup locations. This is not a new plan, however, these changes were only supposed to happen over the next 3-5 years before the pandemic. The new store formats are expected to generate slightly lower revenues but with increased profitability.

As for almost every major brand, China continues to be an important long-term growth factor for Starbucks. The number of store locations in the country surpassed 4,400, and the company is on track to add at least 500 net new stores during the current fiscal year (ending in September), significantly more than the 300 stores in the Americas (U.S., Canada and Latin America) over the same period.

We continue to thoughtfully invest in China, a market that has significant long-term growth potential for Starbucks. I am proud of how Starbucks China continues to pave the way as one of our two lead growth markets.”

Source: Kevin Johnson, CEO, Q2 2020 Earnings Call

Operations

As a general rule of thumb, a company has authentic earnings power when it has both defensive and enterprising profits. Thus, when assessing a firm’s operations, we care about two fundamental aspects: it has to pass the cash flow-based stability test, and it must be a consistent shareholder value creator measured in the EVA framework.

Stability: Assessing Cash Flow Consistency

As Hewitt Heiserman writes in his book, It's Earnings That Count: "The most ruinous mistake you can make as a buyer of common stocks is to own a company that goes bankrupt. For this reason, the defensive investor judges the quality of a firm’s accrual profit on the basis of its ability to self-fund. That is, whether it produces from ongoing operations more cash than it consumes, and not go deeper into debt or dilute current

stockholders. When we look at the conventional financial statements, our primary concern, therefore, is the stability of the company’s cash generation."

(Source: Morningstar)

Starbucks has increased its revenues each year over the last ten years and significantly improved its profitability. This growth has translated into cash generation as well, leading to over 11% average annual growth in OCF since 2010, while the firm spent more capital primarily on new store openings and store renovations. It is worth noting that the firm’s OCF in FY2014 was negatively impacted by a $2.8 billion litigation charge due to an arbitration with Kraft (KHC), while positively impacted by $7 billion in FY2018 due prepaid royalties from the partnership with Nestlé (NSRGY). To support continuous growth and boost margins further, Starbucks will spend significant capital on store optimizations in the next 12-18 months, while deferring some expenses to conserve cash during the uncertainty.

As to CapEx, we've already taken steps to trim CapEx this year. That includes the deferral of certain new store openings that were planned for this year, deferring those into next year. That includes, for example, China, where we had originally guided to 600 new stores this year. We've taken that down to at least 500. So there is some deferral of capital associated with that, and we've taken the opportunity to trim some of our other capital spending programs, including store refurbishments.”

Source: Patrick Grismer, CFO, Q2 2020 Earnings Call

Regardless of the heavy burden the firm will experience on its cash flow due to COVID-19 in the short term, Starbucks easily passes our stability test. In the next step, we move on to the EVA framework, examining if the company is able to consistently create shareholder value, as EVA cuts through accounting distortions and charges for the use of capital.

Value Creation: Is A Wide-Moat Rating Warranted?

We are only interested in companies whose businesses are protected by large and enduring economic moats, as buying those companies at the right price generally leads to overperformance, as outlined in our research article. In the EVA framework, the EVA Margin (EVA/Sales) can serve as our ratio to define a company’s moat. A 5% EVA Margin can be used as an indicator for a “good” company, whereas persistence of a 5%+ EVA Margin for 10 years makes a company great and thus “moaty.”

By looking at the chart below, we see Starbucks’ exceptional EVA Margin levels, with a steady growth since the last financial crisis. Over the last 10 years, the company averaged around 9% EVA Margins, which showcases the remarkable quality of Starbucks. The firm was able to produce double-digit EVA Margins during the last 4 years, which, in our view, could potentially expand even further due to the recent store optimization plans that will require less capital from the business in the long term, translating into lower capital intensity.

(Source: evaexpress.com)

Starbucks’ ability to sell its coffees at a premium price due to its world-class brand and customer loyalty is clearly indicated in its EVA Margin levels. The existence of a wide moat in case of Starbucks, therefore, has bulletproof evidence by the numbers.

Assessing incremental EVA returns

EVA Momentum measures the growth rate in EVA, scaled to the size of the business (measured by its sales). It is the EVA framework’s equivalent for Return On Incremental Invested Capital, or ROIIC. Any positive EVA Momentum is good because it means EVA has increased, and it is an indication that it is worthwhile to reinvest capital in the underlying business. Instead of pinpointing any single-year performance, we prefer to look at the long-term averages in EVA Momentum.

(Source: Author’s calculation based on data from evaexpress.com)

Over the last 10 years, Starbucks generated an average EVA Momentum of 2.1%, which was primarily driven by an over two-fold increase in sales with matching growth in EVA Margins. To put that into perspective, the long-run average for the 75th percentile of the US stock market (represented by the Russell 3000) is 1.0-1.5% percent. This is a prime example of a combination of productivity gains paired with profitable growth, indicating favorable business conditions and management’s exceptional stewardship.

Although sales growth declined somewhat recently, it was compensated by an increase in EVA Margins into the double-digit territory.

Due to the multiple new markets where Starbucks has a presence, and the new store formats in the U.S. which will be introduced in the next 12-18 months, the firm will likely be able to keep up the recent positive performance. The figures support the rationale behind continuous capital reinvestment in the business, as EVA will most likely continue to grow at a healthy rate in the foreseeable future.

Our take on the moat

The EVA framework enabled us so far to prove, from a rearview mirror perspective, whether the company has an economic moat based on its historical consistency of shareholder value creation. We think Starbucks deserves a wide-moat rating from a qualitative perspective as well, due to its premium pricing capability and meaningful scale advantages over its peers. The industry has nonexistent switching costs and low barriers to entry, however, Starbucks’ digital offering and its 19.4 million Rewards members will make it hard for new competitors to reach the company’s scale.

In addition, Starbucks has several valuable partnerships for improving its channel development, such as the recent Global Coffee Alliance partnership with Nestlé to market, sell and distribute Starbucks products around 200 markets across the globe. The

company also expanded its delivery services via partnerships with UberEats (UBER) in the U.S. and Alibaba’s (BABA) Ele.me in China. Based on all the above, we believe the company has a competitive position that enables it to outearn its WACC for decades to come.

Taking a brief snapshot at the company's debt profile, Starbucks has a BBB+ credit rating from S&P with a long-term debt-to-capital ratio of 100% due to the massive buybacks during the last two years, which resulted in negative equity on the balance sheet. Despite the elevated leverage, the company's cash generation makes it unlikely that Starbucks would run into financial troubles, while S&P revised its outlook to negative from stable to reflect their expectations for pressured cash flow this year and the risk of a sustained period of weaker credit metrics arising from the effects of the pandemic.

Observing the company’s liquidity, Starbucks has around $2.6 billion in cash and short- term borrowing facilities of $3.5 billion. The firm issued $3 billion in bonds, taking advantage of the recent low rate environment to improve liquidity and pre-fund some of its maturing debts. Although the company had a significant weekly cash burn of $125 million at the peak of the crisis in April, the weekly cash flow was expected to be positive by the end of Q3 in June.

We remain committed to our BBB+/Baa1 credit rating and leverage cap of three times rent-adjusted EBITDA. While the impacts of COVID-19 will cause us to exceed that leverage cap for a period of time, we view these impacts to be temporary and

we expect our leverage to return to near three times rent-adjusted EBITDA in the latter part of fiscal 2021. In short, our leverage policy is unchanged.”

Source: Kevin Johnson, CEO, and Patrick Grismer, CFO, June 10th, 2020 Shareholder Report

Summary of operations - The Quality Score

The EVA framework’s Quality Score is a comprehensive way to assess a company’s overall quality, by combining its EVA-based Performance (EVA Margin and Trend) and Risk (e.g. Volatility and Vulnerability) metrics into a single score, measured against the broader market. In case of extraordinary companies, we would like to see a Quality Score consistently above 80 over a long period of time. As outlined in our research article, the upper quintile tends to outperform the market historically.

In the case of Starbucks, the company’s Quality Score has been nothing but exceptional for the last ten years, consistently sticking to the upper end of the range over the period. The company’s Quality Score took a hit recently due to the impact of COVID-19, which drove FCF lower, while also driving stock volatility higher, resulting in an elevated Risk Score. This is similar to what happened to the Quality Score between 2007 and 2009, when the firm experienced temporarily depressed EVA and FCF levels, coupled with higher stock volatility due to the global financial crisis. If Starbucks can avoid another global shutdown, it should come out of the recent crisis with no significant long-term

negative effects, and inevitably, the Quality Score could rise back to the upper quintile over time.

(Source: evaexpress.com)

Concluding the operations dimension: although the company’s EVA Momentum and Quality Score took a hit due to the recent global downturn, we are confident that Starbucks’ exceptional brand loyalty and scale, along with investments into store optimization and digitalization, will continue to enable exceptional shareholder value creation going forward. The company passes our operational criteria with ease, while Starbucks’ wide-moat rating is fully warranted both from a quantitative and a qualitative standpoint.

Capital Allocation

After looking at the operations dimension, we continue investigating the company through the capital allocation lens. Remember, incremental return on invested capital (measured by EVA Momentum) is a crucial element when it comes to the assessment of successful capital allocation by management. If the company can earn a positive EVA by reinvesting all the cash generated by the underlying business, shareholders are better off if the firm retains most of its earnings. In the table below, we have dissected all the possible uses of cash for Starbucks over the last 10 years.

(Source: Morningstar)

Starbucks reinvests around 30-40% of its OCF on average, which is not unusual for a retail-based company. CapEx is primarily spent on new store openings and existing store renovations.

Due primarily to the deferral of some new store openings and store refurbishments, we now expect capital expenditures for fiscal 2020 to total approximately $1.5 billion or $300 million lower than our original plan prior to the onset of COVID-19.”

As indicated by the average EVA Momentum of 2.1%, it is in shareholders’ best interest that Starbucks keeps reinvesting into its business, given that it can maintain its positive EVA Momentum. The company plans to increase its number of stores in growth areas such as China and India, while improving efficiency in its U.S. stores. The rest of the firm’s cash flow is rightfully distributed to shareholders via share repurchases and dividends.

As illustrated on the graph above, Starbucks returns all of its free cash flow to its shareholders and some more. Between 2010 and 2019, the company generated an aggregate of $25.9 billion in free cash (including a negative FCF of $553 million for FY2014), while buybacks and dividend payments amounted to $33.1 billion, or 128% of FCF. The rest was funded by issuance of long-term debt of $10.5 billion slightly offset by purchase of investments of $1.1 billion. In spite of negative FCF in FY2014, the firm kept its uninterrupted dividend payments and buybacks, reflecting management’s strong commitment to returning cash to shareholders.

Share Buybacks

Starbucks has been returning significant cash via share repurchases to its owners during the last two years, spending $7.1 billion and $10.2 billion in FY2018 and FY2019, respectively. The company repurchased another $1.7 billion of its shares during the first two quarters in FY2020 and the board authorized another buyback program, raising total available shares for repurchase to 48.9 million, or 4% of outstanding shares. In April 2020, the firm announced a temporary suspension of share repurchases to preserve capital due to the impact of COVID-19.

“In addition to accessing additional capital to bridge near-term cash needs, which we expect to peak in Q3, we are creating additional room for investment in our partners and the business more broadly by suspending share repurchases, reducing discretionary expenses and deferring certain capital expenditures”.

It is always crucial to look at whether share buybacks are executed in an opportunistic manner. In the case of Starbucks, the majority of the share repurchases happened over FY2018 and FY2019, when shares were relatively fairly valued historically, defined by the Future Growth Reliance indicator. We could argue that they could have been more opportunistic, however, it is always easy to be smart in hindsight, and management may also have had a different opinion about the valuation of the company at the time. Starbucks took advantage of the lower valuations in the first two quarters of FY2020 when it repurchased ~$1.7 billion of its shares, which is a positive. Overall, management’s willingness to return cash to shareholders via buybacks is unquestionable, but it might be only after the dust settles that the company restarts the program.

Dividend

Starbucks paid its first dividend in 2010, and it has done ever since on a consistent basis, putting together a dividend raising streak of 10 years. With that being said, a "dividend promise" can be wonderful, but it can be a heavy burden as well. A good dividend is one that's paid out with money that management cannot efficiently allocate to profitable growth. As of Q2 2020, the company remains committed to paying its dividend, while it remains a question whether the usual increase will come like clockwork at the end of October. One of the things that we're proud of is that we're able to maintain our commitment to shareholders, to provide some measure of certain return in an uncertain investment environment. So our intention today is to continue to pay our quarterly dividend.”

Growth rates are nothing but excellent, indicating 23.4% CAGR for the last 10 years. The dividend seems to be safe (averaging around 49% of FCF in the last ten years), and as per the CFO’s comments during the last earnings call, we do not expect to see any changes in the foreseeable future. The current dividend yield of 2.2% is considered to be in the higher end of the company’s range historically, while future dividend increases will likely be along the lines of 10% going forward.

Acquisitions

In general, Starbucks’ growth has been almost entirely organic, which is a significant positive, in our view. The company’s largest acquisition to date was a $1.4 billion purchase of the remaining 50% interest of its East China joint venture in FY2018. The firm also made some strategic acquisitions, including Teavana for $620 million in FY2013 and some bolt-on purchases such as Princi and Evolution Fresh, to broaden its offering throughout the years.

Valuation

Future Growth Reliance

Our prime historical valuation indicator in the EVA world is the Future Growth Reliance (FGR), which is the percent proportion of the firm’s market value that is derived from, and depends on growth, in EVA. As outlined in our research article, it is the best-of-breed sentiment indicator that addresses accounting distortions, and thus gives us a true picture of which wide-moat companies seem attractively valued in historical terms.

Starbucks is currently trading at 25% FGR, slightly under its 5- and 10-year average valuation of 32%. During the first few months of 2020, FGR was at its lowest level since 2009 standing at 18%, signaling an exceptional buying opportunity at the time. Shares have bounced back since, but the FGR still indicates slight undervaluation in historical terms.

Morningstar DCF

As a second step, we use Morningstar’s valuation system, where analysts create industry and company-specific assumptions, and then all the inputs are used in a discounted cash flow model. In order to reflect all moving parts within the business, Morningstar also evaluates the level of uncertainty with all the stocks it covers. Morningstar assigns Starbucks a medium uncertainty rating with a $86 fair value. The thresholds between the different star ratings are illustrated below:

With the stock currently trading at $74.29 as of July 10th, a 4-star rating is warranted, implying that shares are slightly undervalued based on Morningstar’s estimate, in line with what the FGR metric defines as historical average valuation level. Thus, Starbucks seems to provide some margin of safety at current levels, however, it is still far from a bargain offering at this time.

Summary of investment thesis

PRVit score - Heat map vs. market

After all our due diligence, we turn to the PRVit model for a final judgment of the overall attractiveness of a stock. The PRVit is a multifactor quantitative stock selection model based on EVA-centric measures of Performance, Risk and Valuation. Combining a company's Quality Score with its actual Valuation Score can be visualized on a heat map like the one below, where the gradient diagonal line signals fair value. We want to see a stock in the upper right hand-side corner of this heat map, but we are more concerned

with the Quality Score, as we believe that over the long run, we are better off with a truly exceptional business bought at a fair price rather than a fair company bought at an exceptionally attractive price.

(Source: evaexpress.com)

As indicated on the heat map above, Starbucks’ Quality Score sits below our desired top quantile currently, driven by lower profitability, temporarily distressed free cash flow and increased debt due to the pandemic. With that being said, if this pandemic is managed successfully, the Quality Score could improve in the near future. Given the retail nature of the business, it would be crucial for Starbucks to avoid another worldwide shutdown in order to maintain same-store sales levels (although, to be fair, this is out of the company's control). Nevertheless, this current crisis is encouraging the company to improve its store portfolio by further digitalization and optimization, which could ultimately widen its economic moat in the long term.

In our view, this stock is a pass at the current valuation. We would only be comfortable with a higher margin of safety, since the company is significantly exposed to the current

economic uncertainty and we tend to be extra cautious with retailers in general. Therefore, we are setting a target entry price below $61 for enterprising investors, translating to a historically attractive FGR ratio in the ~15% range and in line with Morningstar’s 5-star

valuation threshold. Still, our most conservative analyst would stay on the sidelines until shares reach bargain-basement levels around the $49 mark, translating to a 0% FGR (or 0 baked-in EVA growth) scenario.

One more thing

If you liked this analysis and don't want to miss any of the upcoming articles by our evidence-based stock selection process exclusive for SA readers, please scroll up and click "Follow" to be notified of future releases.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.