虛擬貨幣(加密貨幣)剛出現的時候,如果不說這是一種創時代的貨幣,你可能還以為這是種代幣,一種遊戲幣。就以現實層面來看,虛擬貨幣與遊戲幣並沒有太大的差別,都是一種電子紀錄的存在,其差異在於不可移除的交易紀錄這方面。

有多少人還記得,比特幣開始漲價之後,又出現了幾千上萬種各種虛擬貨幣,在你還未讀到下面的內容前,請回想一下,你還記得當紅一時炒的價格誇張的虛擬產品嗎?它叫什麼名字?

NFT,曾經被人說是藝術的未來的非同質化代幣。當時一個頭貼可以炒到幾百上千萬,現在剩多少呢?CryptoPunk #7523 以1175萬美元成交,創下了驚人的紀錄。之後這個作品呢?還有多少人記得,推特創始人的首條推文NFT2021年3月最高成交價290萬美元,2022年4月最低成交價277美元。

貨幣的本質是用於交易的載體,不論貨幣的造形或存在形式為何。比如說用貝殼做的、用金屬做的、用紙做的、銀行帳戶上的一串數字。而貨幣最重要的在於其信用價值,信用則是由擔保產生。比如說,我取出一塊有造型的石頭,並且與其他人交易,擔保這塊石頭若交易過後沒辦法再換其它東西,我以1000美元購回,並且立了契約。那麼這塊平凡的石頭,最低價值就是1000美元。過了幾年,我發財了或者遇到了奇遇,成了外星人外交大使,那麼這塊有契約的石頭可能價值幾百萬上千萬美元。

為什麼平凡的石頭會有價值?它不是應該放在路邊可能都沒人想撿走的嗎?

而虛擬貨幣扣除區塊鏈的技術後,它與眾多遊戲產生的遊戲內虛擬貨幣有什麼不同?

它就像是又一個被炒作的球莖,承受了太多世人的過多的期待與炒作,換個聽起來高大上的詞,投資與空投。A先生創立了一個虛擬貨幣並且發行了,預計有75億枚,並投入了大量的廣告,創帳戶即送代幣,初始代幣每個幾乎等價10美元。那麼這個750億美元該由誰買單?中間產生的各種費用又由誰來買單呢?挖礦的礦主們,就是要獲利的,而在貨幣交易中有人獲利就有人要虧錢。那又是誰虧了這筆錢呢?

目前世界上有許多人或國家投入了大量的電力在挖礦上面,因為現在的比幣值可能值個十萬美元。那麼那些非主流的虛擬貨幣呢?最終清算時該由誰買單?世界不缺聰明人,但是這種抓交替的故事,總是一直循環上演。因為人類除了墮性還有賭性,「我不會是最後一個」這可能深信在每一個賭徒心中。

而最有價值的「加密區塊鏈技術」目前則是要被拋棄的存在,當一個虛擬貨幣少了「加密區塊鏈技術」後又跟可以隨意增加減少的電子遊戲幣有什麼差別嗎?甚至連娛樂的價值都沒有。連由政府發行的紙鈔都可以變成廢紙了,那麼你又會對由企業家或者個人所發行的虛擬貨幣產生多少信心?

—---------

When cryptocurrencies (virtual currencies) first appeared, if no one mentioned that they were revolutionary monetary tools, you might have mistaken them for tokens or game coins. From a practical perspective, virtual currencies don’t differ much from game coins, as both exist as electronic records. The distinction lies in their immutable transaction records.

How many people still remember the explosion of new cryptocurrencies after Bitcoin's price began to rise? Thousands or even tens of thousands of cryptocurrencies emerged. Before reading further, try to recall — do you remember any once-popular virtual products with absurdly high prices? What were they called?

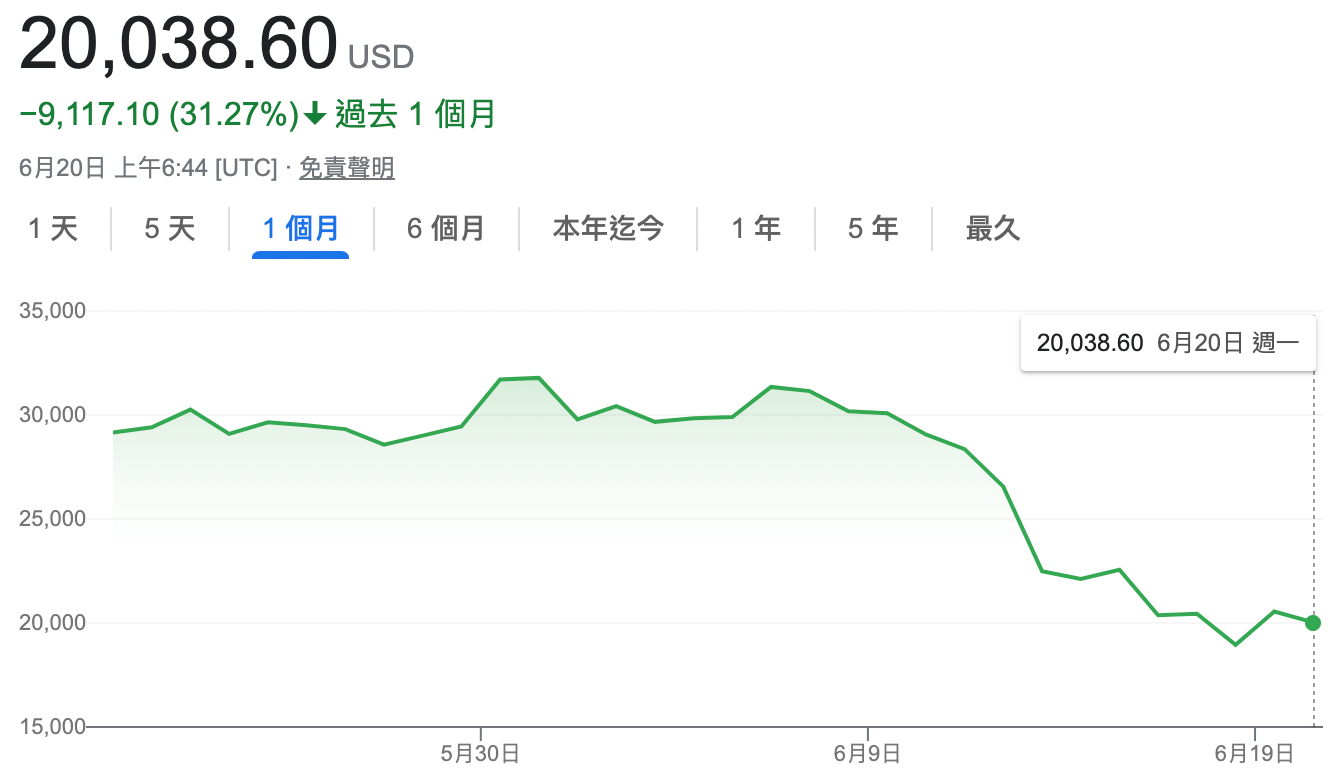

NFTs, or non-fungible tokens, were once heralded as the future of art. Back then, a profile picture NFT could fetch millions or even tens of millions of dollars. What are they worth now? For instance, CryptoPunk #7523 sold for $11.75 million, setting a stunning record. And now? Does anyone even remember it? Similarly, the first tweet NFT by Twitter’s founder sold for $2.9 million in March 2021. By April 2022, its lowest bid was just $277.

The essence of currency is as a medium of exchange, regardless of its form—whether shells, metal coins, paper money, or a string of digits in a bank account. The most crucial aspect of currency is its credit value, which is backed by guarantees. For instance, if I take out a piece of shaped stone and use it in transactions, guaranteeing that if it becomes non-exchangeable, I will buy it back for $1,000 and formalize this agreement in writing, that ordinary stone would have a minimum value of $1,000. Over time, if I become wealthy or have a stroke of luck, such as becoming an ambassador for extraterrestrial affairs, the value of that contracted stone might skyrocket to millions.

Why would an ordinary stone have value? Isn’t it just something lying on the roadside that no one would pick up?

Stripping away the blockchain technology, how is virtual currency fundamentally different from the in-game virtual currencies in countless online games?

It’s akin to another hyped tulip bulb, burdened with excessive expectations and speculation. Replace the terms with fancier ones like “investment” and “airdrop.” Imagine Mr. A launching a cryptocurrency with a supply of 7.5 billion tokens, heavily advertising it, and offering free tokens upon account creation. If each token starts with a value equivalent to $10, who ultimately foots the $75 billion bill? Who bears the various costs incurred during this process? The miners, aiming for profits, must be compensated. In any monetary transaction, someone’s profit equals someone else’s loss. So, who loses in this equation?

Today, many individuals and nations consume vast amounts of electricity mining cryptocurrencies, primarily because a single Bitcoin might now be worth tens of thousands of dollars. But what about non-mainstream cryptocurrencies? When it all comes crashing down, who will bear the losses? The world isn’t short of clever people, yet this game of passing the baton keeps recurring. Why? Because humans are not only inherently lazy but also inherently gamblers. "I won’t be the last one holding the bag"—perhaps this belief lies in the heart of every gambler.

As for the valuable "blockchain encryption technology," it is now in danger of being abandoned. Without blockchain encryption, how is cryptocurrency any different from game coins that can be freely created or removed? It wouldn’t even have the entertainment value of game currency. If government-issued paper money can turn into wastepaper, how much confidence would you have in cryptocurrencies issued by entrepreneurs or individuals?