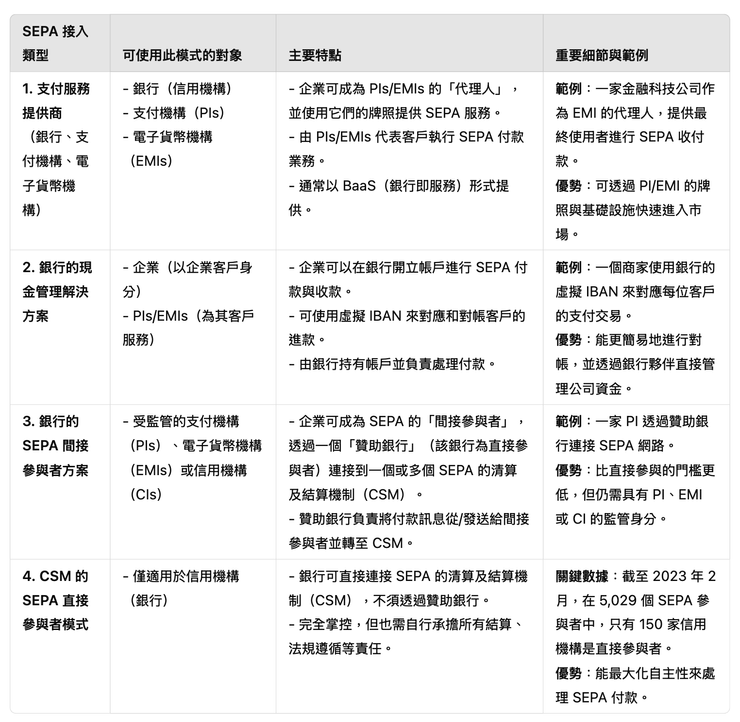

FinTech代表其客戶進行 SEPA 付款與收款的四種主要模式的說明。每種模式都會說明可以使用該模式的機構(例如銀行、支付機構、電子貨幣機構)、它們如何連接至 SEPA(直接或間接),以及其關鍵考量(牌照、贊助銀行等)。截至 2023 年 2 月,在歐洲 5,029 個 SEPA 參與者中,只有 150 家信用機構(銀行)屬於直接 SEPA 參與者。

關鍵要點

- 牌照很重要:PIs/EMIs 必須依賴贊助銀行(間接參與者)或成為現有 PIs/EMIs 的代理人來處理 SEPA 付款。只有信用機構可成為直接參與者。

- 多元接入模式:企業可選擇成為 PI/EMI 的代理人、使用銀行現金管理方案,或在具備足夠牌照的情況下作為間接或直接參與者連結至 SEPA。

- 直接參與者較少:直接參與僅限於少數的信用機構(銀行),雖然可取得較高的主導權,但需要更嚴格的法規遵守和基礎設施投入。

備註: PI, payment institution;EMI:Electronic Money Institution;BaaS:Banking-as-a-Service;CSM stands for Clearing and Settlement Mechanism.In the context of SEPA and payment systems:

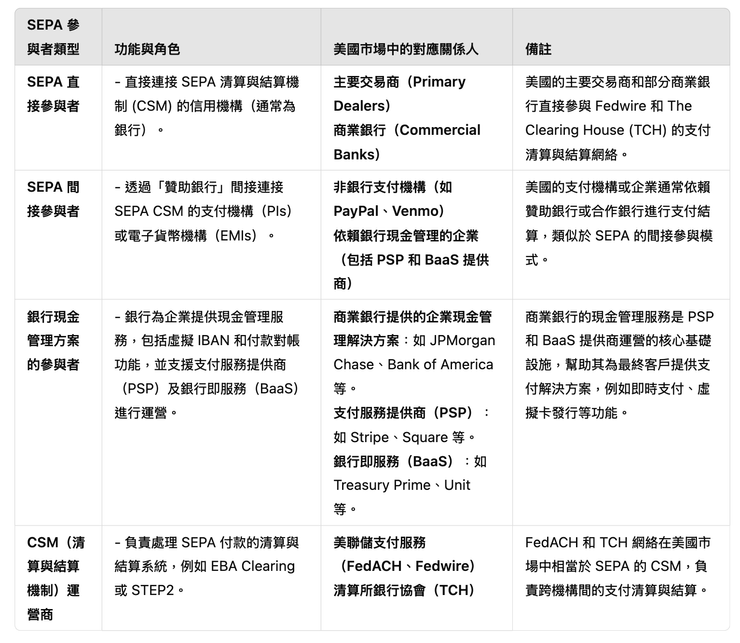

美國市場

關鍵要點

- 牌照很重要:PIs/EMIs 必須依賴贊助銀行(間接參與者)或成為現有 PIs/EMIs 的代理人來處理 SEPA 付款。只有信用機構可成為直接參與者。

- 多元接入模式:企業可選擇成為 PI/EMI 的代理人、使用銀行現金管理方案,或在具備足夠牌照的情況下作為間接或直接參與者連結至 SEPA。

- 直接參與者較少:直接參與僅限於少數的信用機構(銀行),雖然可取得較高的主導權,但需要更嚴格的法規遵守和基礎設施投入。

- BaaS:在銀行資金管理產品的最前端,解決企業用戶要使用銀行資金管理服務的介接痛點與多銀行介接工。並拓展成為平台讓更多小型企業可快速使用銀行資管理服務。廣義說起來,所有商店收非現金支付,提供服務的業者都算BaaS

備註

CSM stands for Clearing and Settlement Mechanism.In the context of SEPA and payment systems:

Clearing refers to the process of transmitting, reconciling, and confirming payment instructions between financial institutions before the actual settlement of funds.

Settlement is the actual transfer of funds between financial institutions, usually involving a central bank or other clearinghouse.

Examples of CSMs in SEPA include EBA Clearing (operating systems like STEP2) and RT1.

In the U.S., equivalent systems would be FedACH, Fedwire, or The Clearing House (TCH) networks. These systems ensure that payments between different institutions are processed securely and efficiently.