- 歡迎到「三苗討論區」(方格子平台)留言討論。

- 本站在幹嘛?歡迎參考〈追蹤股票名單、寫作方向和專欄架構〉一文;美股投資新手必讀:〈寫給美股新手的投資階梯〉。

- 加入免費的Discord群組接收科技成長股新聞資訊、並獲得最新文章通知,另外還有公開的Telegram群組討論美股,和臉書粉絲專頁。

- 所有付費訂閱讀者,都可申請加入專屬的TG群組。除了我之外,群裡面也有很多高手不時分享和討論投資想法,集思廣益。申請辦法詳見這篇。

- 關於我對Datadog(DDOG)的基本看法,可在索引檔案找到。

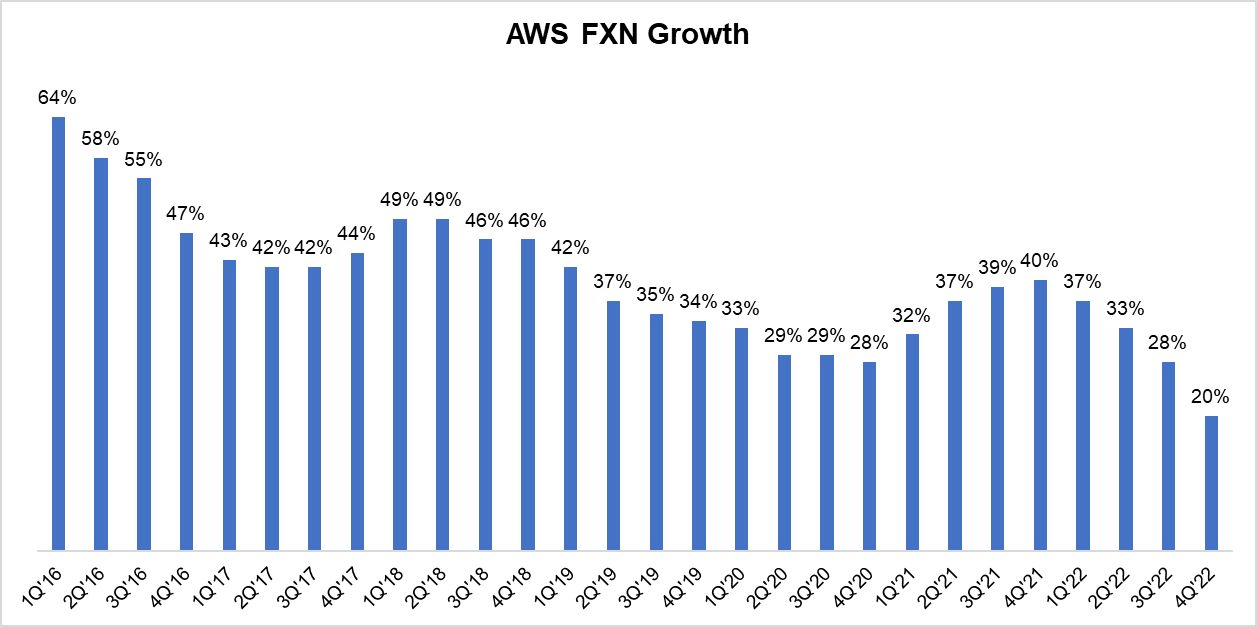

DDOG最新這份2022Q4財報,營收放緩趨勢跟我預期的差不多,但放緩幅度比很多同等級軟體股要再弱一些(其他多半還能「保3」),而跟科技巨頭的雲端業務部門較為接近,像是亞馬遜的AWS(年增20%左右)。

管理層提到,DDOG的業務跟巨頭雲端基礎建設的起伏趨勢脈動相似,像是營收增長在整個Q4都快速冷卻(AMZN也提到同樣狀況),故DDOG管理層在為今年2023年制訂指引時,AMZN等雲端巨頭的展望是其重要參考依據。

Yes. So look, we -- obviously, we see -- we get data from our customers using those cloud providers. We also listen to the commentary that cloud providers provide on their -- in terms of their own growth. There's not a one-to-one mapping between what happens on the revenue side for the cloud providers and what we see on the infrastructure side on our end. But we are seeing some of the same trends where their growth slowed down throughout Q4. And we've been listening to their comments when they give guidance for what that growth might look like in the near future, which also informed our own guidance.

To dive into some of the drivers of our Q4 performance, first, we saw existing customer usage growth in October and November at a similar level to what we saw in Q2 and Q3. In the month of December, we saw a slower growth dynamic as the typical slowdown we see at the end of December was more pronounced than in previous years. As a result, the growth rate in usage by existing customers was lower in Q4 than in Q2 and Q3.

DDOG本季營收增長44%,預計下一季增長29%,預計今年全年增長25%。我個人現在會以2023年全年營收增長30%作為基準。只要指引高於30%,我覺得表現都還可以接受,包括BILL、CFLT、NET、MNDY,等等。然而,DDOG現在預期今年全年營收增長只有25%,我覺得不論是與其他軟體公司比較,還是跟DDOG自身的歷史成績比較,都稍為偏弱了一點。

如果看看亞馬遜AWS的狀況,基本上就是2022Q3年增率顯著放緩,而從Q4延續到當前是進一步冷卻,今年Q1到目前為止只有15%左右年增率,且管理層認為無法預測今年接下來會有怎樣的表現,不確定性非常高,因為導致營收增長放緩的因素持續存在(optimization),下文會進一步解釋。

Moving on to AWS. Net sales increased $21.4 billion in Q4, up 20% year-over-year and now representing an annualized sales run rate of more than $85 billion. Starting back in the middle of the third quarter of 2022, we saw our year-over-year growth rates slow as enterprises of all sizes evaluated ways to optimize their cloud spending in response to the tough macroeconomic conditions. As expected, these optimization efforts continued into the fourth quarter.

As we look ahead, we expect these optimization efforts will continue to be a headwind to AWS growth in at least the next couple of quarters. So far in the first month of the year, AWS year-over-year revenue growth is in the mid-teens. That said, stepping back, our new customer pipeline remains healthy and robust, and there are many customers continuing to put plans in place to migrate to the cloud and commit to AWS over the long term.

So on the AWS growth rate, I'm not sure I can forecast for you with any level of certainty what is going to happen beyond this quarter.

當然,若暫排除營收增長的問題,DDOG的盈利和現金流是穩定的,包括Non-GAAP operating margin提升了1個百分點,從上一季的17%增加到18%。自由現金流利潤率也由上一季的15%增加到21%。營業現金流流入1.14億,帳上現金(Cash and cash equivalents + Marketable securities)創近期新高,達18.8億美元,財務狀況十分穩健。

We've always said that our free cash flow has been around slightly higher than our EBIT margin. If you look back, you'll see that it's, in some quarters a little above, in some quarters a little below. We have not seen any changes of -- material changes in payment terms or the flows of cash. So there's nothing we've seen so far that would cause us to change our views about cash flow conversion for the company.

看了DDOG這些財報數據,我腦袋中第一個問題是,在同樣的經濟環境下,為什麼DDOG的營收增長比其他軟體公司弱?要知道在2022Q1,DDOG的營收年增率仍然高達83%,現在卻預期2023年只有25%的增長,起伏頗大。