結論:殖利率曲線的確在3Q23有技術性的上揚狀況,但是於中期(6-12個月)實際上沒有絕對足夠跳升的動力,除非美國經濟出現猛爆性的增長,至於更長期來說,Ackman所言的國際局勢有其合理性,但是,其程度可能較現在看來得溫和平緩。Ackman所言僅供參考,主要他還是為了自己的交易,而非單純客觀的陳述現實,但是,現實上,的確在”短期”客觀環境對其有利。

英文原文在最下方,下面是摘要。

(1)認為通膨因為結構性原因,長期應該是3%並非2%。

(2)財政部不發長債,而集中發短債是錯誤的(新興市場許多國家都有一貫的錯誤)

(3)其他國家在與美國脫鉤(de-couple)

30年期美債殖利率=3%(通膨)+0.5%(實質利率)+2%(term premium,期限溢價) =5.5%。

筆者comment:

(A)通膨是否存在Bill Ackman談的長期性因素,的確是,例如從中國脫鉤(de couple)造成全球以及美國物價通縮的效應減弱,這是的確。但是實際上,這是非常長期的問題,不是立刻的影響。

(B)財政部在8月開始是積極發長債的。美國財政部並不傻,當家的是之前的Fed主席Yellen,怎麼可能會不了解金融循環。因此,其實財政部這次是在七月已經把短債的額度發滿之後(對,財政部是不能卯起來只發短債的),八月開始發長債。此外,如果盡力只發短債,而不發長債的理由往往只有一個,就是看壞通膨前景(通膨上揚)。而如果Yellen短期其實已經盡力發短債,也意味著Yellen並不看壞未來兩三年的通膨前景。(會往下走)。因此,如果把短債額度發到滿,屆時可以refinancing)。換個角度說,Yellen也認為Fed會在能盡量不讓金融市場太動盪的狀況下,全力壓制通膨。(會不會衰退這是另一個問題)

(C)但是,全球央行,例如中日(日本可能主要是大媽)對美債decouple,這也是長期趨勢,並非1-2個月的事情。

(D) 因此,其實我們可以得到一個概略性的結論。就是至少Bill Ackman說的頂多是”似是而非”的事實。至少時空架構,跟現在的交易是搭不上的。恐怕更多的是為了他的交易能夠達到目的。

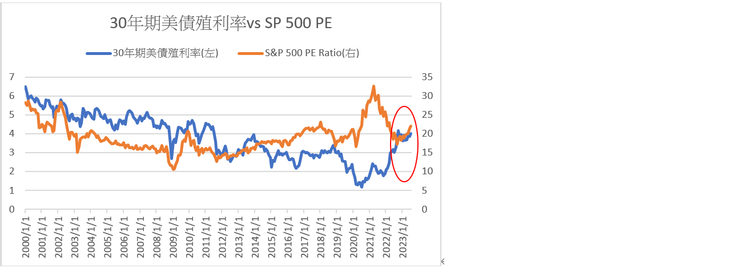

(E)美國的國債殖利率筆者不敢妄言結構性因素是不是真的會一定要顯著往上推,但是機率低。短期,其實技術性層面問題(財政部發債補充現金)的占比非常高。而這現象,可能得持續整個3Q23。而,下圖是美國股市PE與30年期公債殖利率的對比。(過往一段時間是反向,但是看來有點背離,要馬是30年期公債殖利率下來,要馬是股市PE得調整)

(F)巴菲特並未與Bill Ackman對作。巴菲特的作法是去買超短債3-6個月到期的短債。基本上就是政治正確,且不傷身,替代現金parking的一種方式。(意思是巴菲特也不反對短線美債技術性壓力,但是他對長債也沒興趣)

I have been surprised how low US long-term rates have remained in light of structural changes that are likely to lead to higher levels of long-term inflation including de-globalization, higher defense costs, the energy transition, growing entitlements, and the greater bargaining power of workers. As a result, I would be very surprised if we don’t find ourselves in a world with persistent ~3% inflation. From a supply/demand perspective, long-term Treasurys (T) also look overbought. With $32 trillion of debt and large deficits as far as the eye can see and higher refi rates, an increasing supply of T is assured. When you couple new issuance with QT, it is hard to imagine how the market absorbs such a large increase in supply without materially higher rates. I have also been puzzled as to why the

hasn’t been financing our government in the longer part of the curve in light of materially lower long-term rates. This does not look like prudent term management in my opinion. Then consider China’s (and other countries’) desire to decouple financially from the US, YCC ending in Japan increasing the relative appeal of Yen bonds vs. T for the largest foreign owner of T, and growing concerns about US governance, fiscal responsibility, and political divisiveness recently referenced in Fitch’s downgrade. So if long-term inflation is 3% instead of 2% and history holds, then we could see the 30-year T yield = 3% + 0.5% (the real rate) + 2% (term premium) or 5.5%, and it can happen soon. There are many times in history where the bond market reprices the long end of the curve in a matter of weeks, and this seems like one of those times. That’s why we are short in size the 30-year T — first as a hedge on the impact of higher LT rates on stocks, and second because we believe it is a high probability standalone bet. There are few macro investments that still offer reasonably probable asymmetric payoffs and this is one of them. The best hedges are the ones you would invest in anyway even if you didn’t need the hedge. This fits that bill, and also I think we need the hedge.