提早開始!!別低估複利的力量,至少撥一筆錢,讓他為你工作

Buffett and Berkshire 巴菲特和伯克希爾

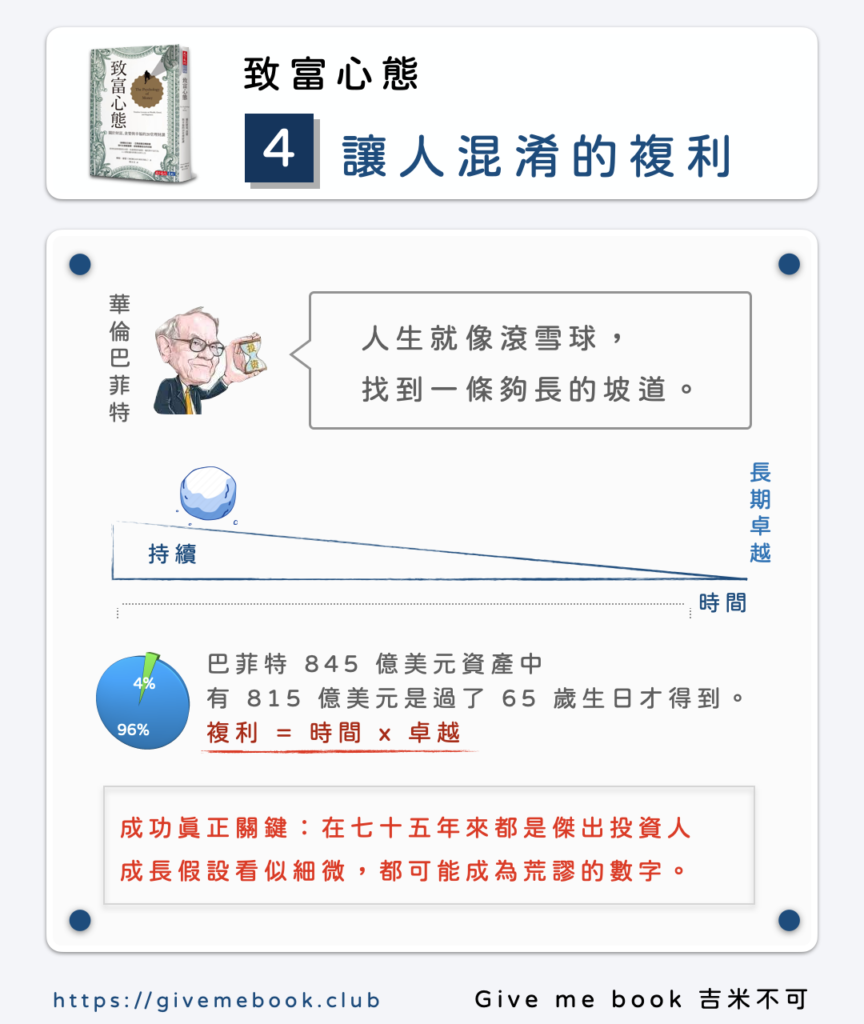

Warren Buffett represents the epitome of long-term compounding when it comes to investing. According to estimates, Buffett’s net worth crossed the $1 billion mark somewhere in his mid-50s. If Buffett were to have just sunsetted into retirement and put his money in bonds, the world may never have seen Buffett as such an incredible investor (although his track record was still amazing then). Instead, he’s continued to run Berkshire and keep his wealth tied to the stock. Buffett is worth $112 billion today, so this means $111 billion (99%) of that came after he turned 50.沃倫·巴菲特代表了長期複利投資的典範。根據估計,巴菲特的淨資產在他50多歲時突破了10億美元的大關。如果巴菲特只是退休並把他的錢投資於債券,世界可能永遠不會見識到他作為一位如此出色的投資者(儘管他的投資記錄當時已經很驚人)。相反,他繼續經營伯克希爾哈撒韋並將他的財富與股票聯繫在一起。如今,巴菲特的身價達到了1120億美元,這意味著其中的1110億美元(99%)是在他50歲之後獲得的。

Power in Starting Early 提早行動的力量

Here is another powerful example of compounding.

這是另一個強而有力的合成的例子。

Here is another powerful example of compounding. Let’s say you have two investors: Investor A saves $1,000/year from the ages of 22 to 30 and then no more from age 31 to 60. Investor B saves $1,000 a year from ages 30 to 60. Both investors achieve an 8% annual return on their investments. Who do you think ends up with more money? Spoiler alert: the power of time and compounding wins, and at 60, Investor A has $135K, and Investor B has $133K, but Investor A only invested for 8 years while Investor B invested for 30 years. See the results here.

這是另一個強而有力的複利例子。假設你有兩位投資者:投資者A從22歲到30歲每年存1000美元,之後從31歲到60歲不再存錢;投資者B從30歲到60歲每年存1000美元。兩位投資者的投資都能獲得8%的年回報率。你認為誰最終會有更多的錢呢?劇透一下:時間和複利的力量贏得了勝利,在60歲時,投資者A有13.5萬美元,而投資者B只有13.3萬美元,但投資者A只投資了8年,而投資者B則投資了30年。在這裡可以看到結果。

Let It Work For You

讓它為你工作

While not at the forefront of investors’ minds or the news headlines, it’s compounding that stands as a silent hero within one’s investment portfolio. Often overlooked or underestimated, its power quietly works behind the scenes, steadily building wealth over time. Whether it’s the gradual accumulation of snow leading to an ice age or the remarkable growth of Warren Buffett’s net worth, the principle of compounding remains a fundamental force in building wealth over time.

雖然投資者的關注點和新聞標題並不在此,但複利卻是投資組合中的無聲英雄。它常常被忽視或低估,但其力量在幕後默默運作,持續積累財富。無論是逐漸積累的雪導致冰河時期,還是華倫·巴菲特凈資產的驚人增長,複利原則始終是長期積累財富的基本力量。

原文網址:

https://blog.validea.com/compounding-the-silent-hero-in-your-investment-portfolio/